August 5, 2024

During the past 18 months, seldom has a vendor issued press release or marketing asset reached the outside world without some – often tenuous – link to artificial intelligence (AI).

Representing a new layer of corporate approval, no industry messaging was complete without an attachment to the technology that continues to take the world by storm. The more confident the vendor, the stronger the promoted link to generative AI (GenAI).

And the tactic worked as large-scale enterprise organisations followed suit, rolling out AI projects to the delight of boardroom executives and shareholders.

But as the dust settles, is GenAI losing its shine among businesses?

“After last year’s hype, executives are impatient to see returns on GenAI investments, yet organisations are struggling to prove and realise value,” observed Rita Sallam, Distinguished Vice President Analyst at Gartner.

“As the scope of initiatives widen, the financial burden of developing and deploying GenAI models is increasingly felt.”

Addressing IT leaders at Gartner Data & Analytics Summit in Sydney, Sallam shared that at least 30% of GenAI projects will be abandoned after proof of concept by the end of 2025, suggesting a softening of market enthusiasm.

This will be primarily due to poor data quality, inadequate risk controls, escalating costs or unclear business value.

According to Sallam, a major challenge for organisations arises in justifying the “substantial investment” in GenAI for productivity enhancement, which can be difficult to directly translate into financial benefit.

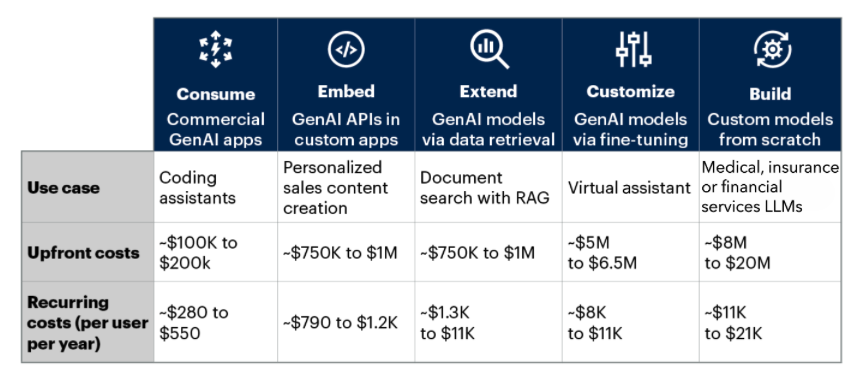

While many companies are leveraging GenAI to transform business models and create new market opportunities, these deployment approaches come with significant costs, ranging from $5 million to $20 million.

As outlined below, the costs incurred in different GenAI deployment approaches span:

“Unfortunately, there is no one size fits all with GenAI, and costs aren’t as predictable as other technologies,” Sallam explained. “What you spend, the use cases you invest in and the deployment approaches you take, all determine the costs.

“Whether you’re a market disruptor and want to infuse AI everywhere, or you have a more conservative focus on productivity gains or extending existing processes, each has different levels of cost, risk, variability and strategic impact.”

Regardless of AI ambition however – and based on Gartner research data – GenAI requires a higher tolerance for indirect, future financial investment criteria versus immediate return on investment (ROI).

Historically, many CFOs have not been comfortable with investing today for indirect value in the future. This reluctance can skew investment allocation to tactical versus strategic outcomes.

At this stage of the adoption cycle, Sallam said early adopters across industries and business processes are reporting a range of improvements that vary by use case, job type and skill level of the worker.

According to Gartner findings, early adopters reported 15.8% revenue increase, 15.2% cost savings and 22.6% productivity improvement on average.

“This data serves as a valuable reference point for assessing the business value derived from GenAI business model innovation,” Sallam said.

“But it’s important to acknowledge the challenges in estimating that value, as benefits are very company, use case, role and workforce specific. Often, the impact may not be immediately evident and may materialise over time. However, this delay doesn’t diminish the potential benefits.”

By analysing the business value and the total costs of GenAI business model innovation, Sallam said organisations can establish the direct ROI and future value impact. This serves as a crucial tool for making informed investment decisions about GenAI business model innovation.

“If the business outcomes meet or exceed expectations, it presents an opportunity to expand investments by scaling GenAI innovation and usage across a broader user base, or implementing it in additional business divisions,” Sallam explained.

“However, if they fall short, it may be necessary to explore alternative innovation scenarios. These insights help organisations strategically allocate resources and determine the most effective path forward.”

But GenAI beneficiaries still reap rewards

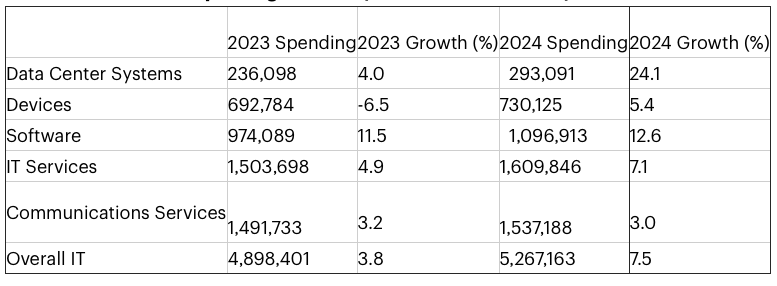

As market doubt on the long-term value of GenAI creeps in, global IT spending is expected to reach $5.26 trillion in 2024, at an increase of 7.5% from 2023.

“GenAI is being felt across all technology segments and subsegments, but not to everyone’s benefit,” noted John-David Lovelock, Distinguished Vice President Analyst at Gartner.

“Some software spending increases are attributable to GenAI, but to a software company, GenAI most closely resembles a tax. Revenue gains from the sale of GenAI add-ons or tokens flow back to their AI model provider partner.”

Spending on data centre systems is expected to increase 24% in 2024, up from the previous quarter’s forecast of 10% growth. This is due in large part to increased planning for GenAI.

“The compute power needs of GenAI are being felt across the data centre, and spending in that segment reflects this ravenous demand,” Lovelock said.

Within the context of global investment, IT services spending is now projected to grow 7.1% in 2024. According to Gartner, this is down from 9.7% within the last forecast, due in part to slower spending across subsegments that include consulting and business process services.

“The change fatigue in CIOs that we saw at the start of the year has now abated and the contract backlogs going back to the third quarter of 2023 are being cleared,” Lovelock added.

“We expect to see a larger rush towards the end of the year to make up for the slow start.”

Inform your opinion with executive guidance, in-depth analysis and business commentary.