October 9, 2023

New Zealand will go to the polls amid the backdrop of sustained economic pressure, with only “marginal growth” forecast during the next 12 months due to challenging domestic and international conditions.

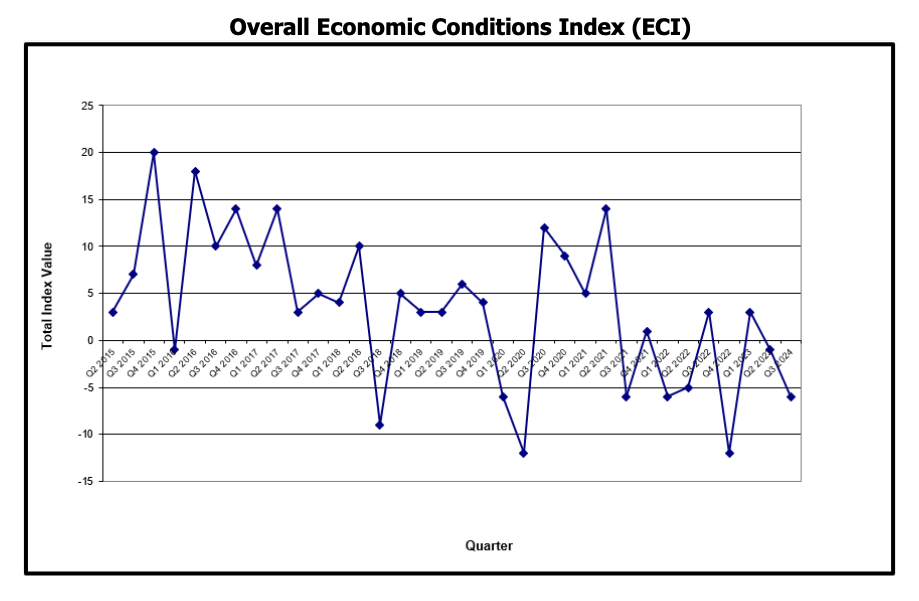

The BusinessNZ Economic Conditions Index for the third quarter of the year – spanning July to September – sits at -6, representing a deterioration of three points on the previous quarter and down nine compared to the same period in 2022.

The Index tracks 33 economic indicators including gross domestic product (GDP), export volumes, commodity prices, inflation, debt and business and consumer confidence.

“We’re coming back from historically low levels of business confidence, with some of the worst we’ve seen in the past 10 years,” said Catherine Beard, Director of Advocacy at BusinessNZ. “Investors remain cautious – with factors like decreased demand, the upcoming election [on 14 October] and the impact any change in policy will have on business being front of mind.”

Business confidence is expected to improve however, although Beard insisted there is still a long way to go.

“Likewise, consumers are feeling the squeeze of prolonged high inflation, increased mortgage repayments, rising costs at the supermarket and at the pump,” Beard added.

“Spending is going to remain tight as people curb any extra spending on top of the basics. Our economy has seen a small bump from the FIFA Women’s World Cup 2023 and increased net migration but overall growth for the next 12 months is expected to be minimal.”

In addition to ongoing domestic challenges, global economic gains are also expected to remain slow for the next few years as countries “focus inward”.

“The price of oil is up, while the price for agricultural goods is down, which is unwelcome news for trade in our part of the world,” Beard explained.

‘Mediocre’ economic growth expected

According to the Index, economic growth is forecast to remain “mediocre” until at least September 2025, with both domestic and international pressures continuing to “bear down” on the local economy.

The latest opening of the government books – the Pre-election Economic and Fiscal Update (PREFU) – suggests that the country will avoid a further recession with “minuscule growth” projected over the next few years.

“Much of it based on significantly increased migration levels,” Beard outlined. “When converted to per capita growth, New Zealand will be going backwards.”

According to new research – Deloitte and Chapman Tripp Election Survey conducted by BusinessNZ – 93% of Kiwi company leaders believe changes made by the Labour Government during the past three years have increased the cost of doing business.

Furthermore, 85% of organisations believe the incumbent government does not have a plan for improved economic performance.

Within this context – and following the latest annual assessment of the economy in New Zealand – the International Monetary Fund (IMF) has forecast growth to slow to around 1% in 2023 and 2024, as tighter monetary policy takes a firmer grip on household spending.

“The IMF shows inflation returning to the Reserve Bank’s target range in 2025 but with interest rates remaining around current levels until 2025,” Beard said.

“Unemployment is also expected to edge up to reach 5% in 2025. There are some key risks facing the New Zealand economy when it comes to improving growth prospects over the next few years.”

As outlined by Beard, such risks include:

Despite industry commentary suggesting that the Reserve Bank may need to continue hiking interest rates beyond the current 5.5%, Beard said the Reserve Bank has been “reasonably upfront” in indicating there is no intention to advance the rate further.

That said, both the Treasury (via PREFU in September) and the Reserve Bank (via the latest Monetary Policy Statement in August) have stated that interest rates will likely stay at the higher rate for longer as a consequence of inflationary pressures remaining relatively strong – although declining.

“Depending on the outcome of the general election, the Reserve Bank Act may be in for a shake-up, particularly if National and ACT secure the treasury benches,” Beard advised.

“Both parties have clearly stated that the Reserve Bank needs to focus principally on maintaining price stability (i.e., a single objective) rather than, as currently, having potentially conflicting objectives in respect to price stability and maximum sustainable employment.”

Furthermore, Beard said the Reserve Bank’s tendency to dabble in other activities – such as climate change and housing – is also likely to be “peeled back” to ensure a “steely focus” on inflation.

“Time will tell whether these, and other possible changes will be made to the Reserve Bank’s operational policy,” Beard added.

Delving deeper, Beard said the annual growth in the Consumers Price Index (CPI) is expected to remain elevated above the Reserve Bank’s 1–3% inflation target band during the year ending September 2023.

This is expected to fall to just under that target band by September 2024, although remaining close to the upper limit well into 2025.

“While inflation has peaked, there is still a significant risk of it remaining elevated as the inflationary expectations of both businesses and consumers, while falling, are still at worrying levels,” Beard observed.

Citing findings from the ANZ New Zealand Business Outlook, Beard said business confidence lifted another nine points in August to -4, the highest since mid-2021. Expected own activity also jumped 10 points to +11 while inflationary expectations continued to ease slightly.

“Despite a significant improvement in business confidence from the doldrums experienced over 2022 and the first half of this year, many sectors are still doing it tough,” Beard summarised.

Inform your opinion with executive guidance, in-depth analysis and business commentary.