February 21, 2024

It’s not always easy to understand the true intentions of reinvention – an action that is often articulated but seldom executed.

For some, it’s simply a line – dropped into media conversations, analyst presentations and shareholder briefings to demonstrate momentum. Just keep on moving.

But in the quiet corridors of power – away from market judgement – reinvention can be viewed as rather paradoxical. The concept of changing a winning formula that has delivered several years of success can be argued as senseless, not strategic.

Eventually however, even the most successful of organisations run out of room to grow. The key is to understand when to jump from the comfort of high maturity to the necessity of high growth – a defining skill of top-performing executives.

“CEOs in Australia generally have high expectations of revenue growth in the next three years, mostly from existing products and services,” observed Kevin Burrowes, CEO of PwC Australia. “In other words, most don’t think they have a burning platform for reinvention – yet.”

In 2024, Burrowes acknowledged that inflation and uncertainty about the Australian economy will continue to put pressure on CEOs to make “tough decisions” balancing their short and long-term priorities.

“There could also be another inhibitor to reinvention: thinking they have more time,” he added.

Citing Australian findings from PwC’s Global CEO Survey in 2024, Burrowes said executive leaders across the country are pursuing business model reinvention at a slower pace – and with less urgency – than their overseas counterparts.

Notably, 85% of Australian CEOs believe their business would exist “as is” in more than 10 years time, significantly at odds with the global trend of 53%.

“Innovation is essential for companies to keep a competitive advantage and remain viable,” Burrowes noted. “Businesses in Australia need to move at pace when it comes to reinvention and new value creation.”

According to PwC, local companies are still mainly relying on existing products and services for most of their revenue (74%) with a failure to embrace new sources of value at the same speed as companies globally.

Just over a quarter (26%) of organisations can attribute more than 20% of total sales from the past 12 months to new products or services introduced within the past three years.

During the past five years, the most common form of reinvention action in Australia has been the adoption of new technologies, followed by the formation of new strategic partnerships. This trend is expected to continue with technology viewed as the leading factor (48%) in how a company will “create, deliver or capture value” in the market.

“CEOs in Australia recognise the need for transformation and most are implementing new technologies to support that,” stated Ro Antao, Transformation Lead Partner at PwC Australia. “However they generally think they still have time to make changes before their revenue growth and viability would be seriously impacted.

“Is this thinking misguided? Is it also a result of having a smaller local market in Australia? The data indicates that CEOs in Australia are not moving fast enough to adjust their business models – and the operational resources that support them – to adapt to the reinvention imperative.”

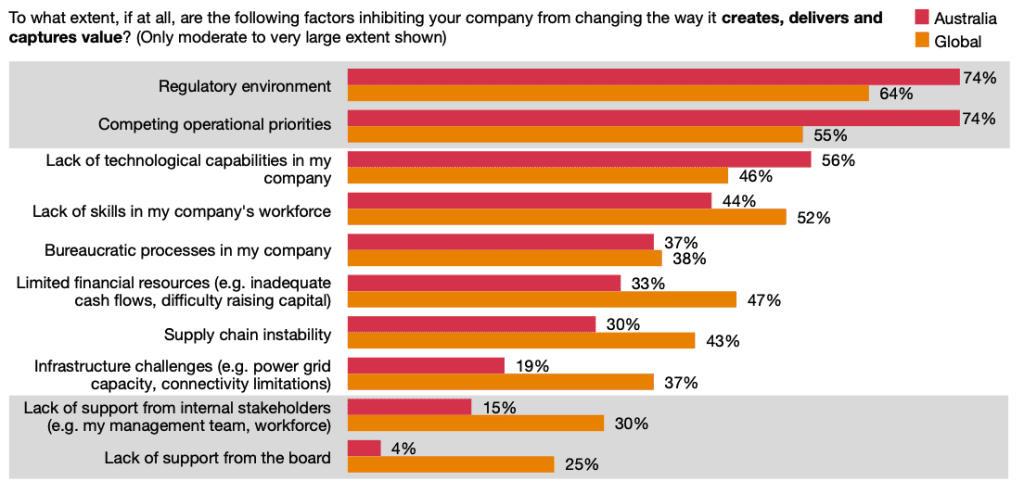

When pressed, CEOs cited regulation and competing operational priorities as major barriers to business model change despite enjoying greater board buy-in and support from internal stakeholders compared to global counterparts.

Within this context, regulation is equally challenging from both internal and external business perspectives as organisations attempt to overcome ongoing hurdles related to compliance with current requirements (70%) and pending changes in regulation (59%).

Following that, the top internal barriers to reinvention are:

“It is not surprising that CEOs perceive regulatory complexity as the biggest challenge to reinvention, given that the consequences of non-compliance have increased dramatically over past years,” acknowledged Corinne Best, Risk and Regulation Lead Partner at PwC Australia.

This is in addition to governments and regulatory bodies trying to keep pace with the global mega trends by implementing new rules and standards for businesses.

“Often, we observe that a change in regulatory requirements leads to a flurry of technology investment or activity to reinvent risk and compliance functions,” Best said.

“To reduce the delivered risk in change projects, companies should have clear transparency on their current compliance requirements and end-to-end risk and controls that can be readily leveraged or overlayed against new regulatory requirements.”

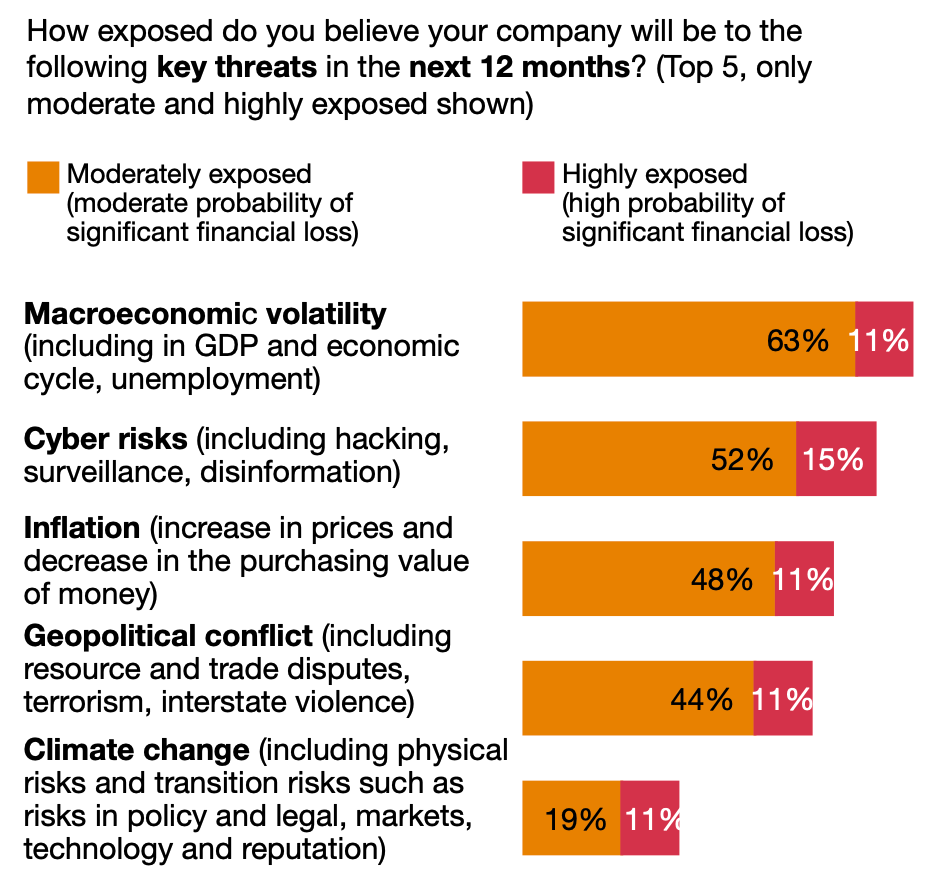

Difficult decisions will continue to be made against the backdrop of an underperforming local economy, with CEOs still considering inflation as a key threat to growth.

While official forecasts show declining gross domestic product (GDP) growth, local CEOs are more optimistic than 12 months earlier.

“This likely reflects a pull-back in the inflation rate and the view that the interest rate cycle is at or near the peak, with consequent hopes that interest rates will fall and consumer sentiment will pick up,” assessed Jeremy Thorpe, Insights and Economics Lead Partner at PwC Australia.

“The expectation of a net decrease in headcount is consistent with official forecasts of higher unemployment. This reflects continuing wages growth and low and patchy economic growth, coming off a historically low unemployment rate.”

Globally, CEOs are more optimistic about growth prospects, with concerns about inflation and macroeconomic volatility falling.

Around the world, the proportion of CEOs who believe economic growth will improve over the next 12-months has more than doubled year-on-year.

According to PwC – which interviewed 4,702 CEOs across 105 countries and territories – 38% of CEOs are optimistic about global economic growth prospects over the next 12-months, up from 18% in 2023. Despite ongoing conflicts, the proportion of CEOs who felt their company is “highly or extremely exposed” to geopolitical conflict risk fell seven percentage points (to 18%).

“There are actionable steps CEOs can take today to accelerate reinvention,” Burrowes shared.

“This includes business model transformation, managing the risks and opportunities presented by climate change, investing in people, and embedding technology such as generative AI [GenAI]. Now is the time for companies in Australia to speed up their business model reinvention.”

Examining the AI opportunity

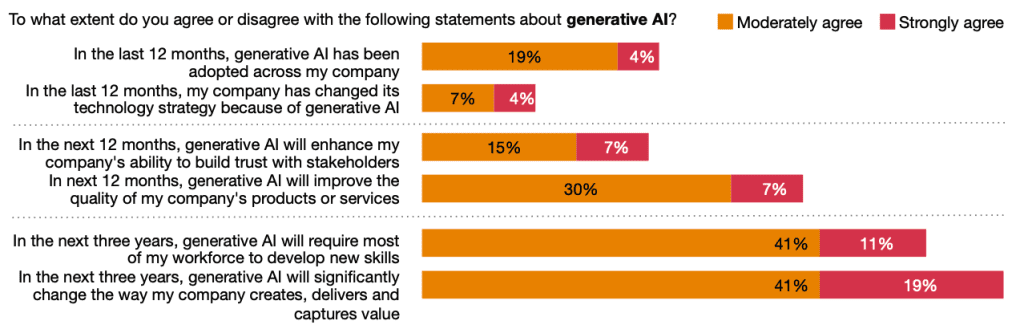

From a solutions standpoint, Australian CEOs overwhelmingly view GenAI as a “catalyst for reinvention” capable of powering “efficiency, innovation and transformational change”.

Specifically, 60% of local leaders accept that this technology will “significantly change” the way their company “creates, delivers and captures value” during the next three years.

Enthusiasm for AI isn’t blind however. Australian CEOs remain wary of the associated cyber security risks (78%) and the spread of misinformation (63%), as well as the legal and reputational considerations (44%) and customer or employee bias (19%).

“GenAI has the potential to unlock a new wave of value from automation, however it is still early in its business adoption cycle,” noted Tom Pagram, AI Leader at PwC Australia. “Most are yet to move beyond experimentation and small-scale pilots.”

In the current economic environment, Pagram said organisations are primarily focused on using GenAI to drive efficiency and cost-savings but “significant opportunities” also remain for companies to leverage this technology for top-line growth.

“This can transform business models, differentiate products and services, improve customer and employee experience and drive an uplift in quality, safety and risk management,” Pagram added.

Inform your opinion with executive guidance, in-depth analysis and business commentary.