November 23, 2023

The art of business building – best expressed as inventing, launching and scaling new product lines, units and services – is back in vogue as organisations assess the most effective strategies to accelerate growth.

This approach is considered by many industry experts as one of the most successful ways to expand competitive share and branch out into new market segments.

Despite ongoing headwinds – whether economically, socially and geopolitically – 73% of companies cite business building as a “major priority”, reflective of an ecosystem weighing up options following a turbulent few years.

According to Boston Consulting Group (BCG) findings, this group of companies have already pursued – on average – five new high-growth opportunities each year since 2021.

“After two decades of building up their digital capabilities, companies are poised to harness these strategic assets for the launch of new ventures and an expedited growth trajectory,” said Beth Viner, Global Head of Venture and Builds at BCG X.

“2023 has undoubtedly been fiscally difficult for many companies but some of the most powerful businesses were launched under tough circumstances. Leaders should feel confident about business building if they adhere to a playbook based on proven results.”

Financially speaking, companies typically allocate 27% of annual revenue to launch, acquire or co-launch start-up ventures.

Broken down further, that primarily spans a self-funded new business build (38%) and the acquisition or acceleration of an existing start-up (24%). This is in addition to forming a joint venture (14%), striking corporate alliances (13%) or accessing venture capital funds (9%).

Specific to time-to-market, companies spend up to three years considering whether to add a new business to their portfolio, and then it typically takes another three years to commercially launch the offering. In some cases, executives are willing to invest three or four years before the business must turn a profit.

On the flip side however, almost half of business leaders (48%) acknowledged that it would take them longer to release a product than it would a start-up. In fact, a large majority identified two or three instances where their competitors launched businesses that they believe they could and should have launched first.

The report – How Companies Can Speed Up the Business of Business Building – surveyed 1,051 senior leaders in 17 countries.

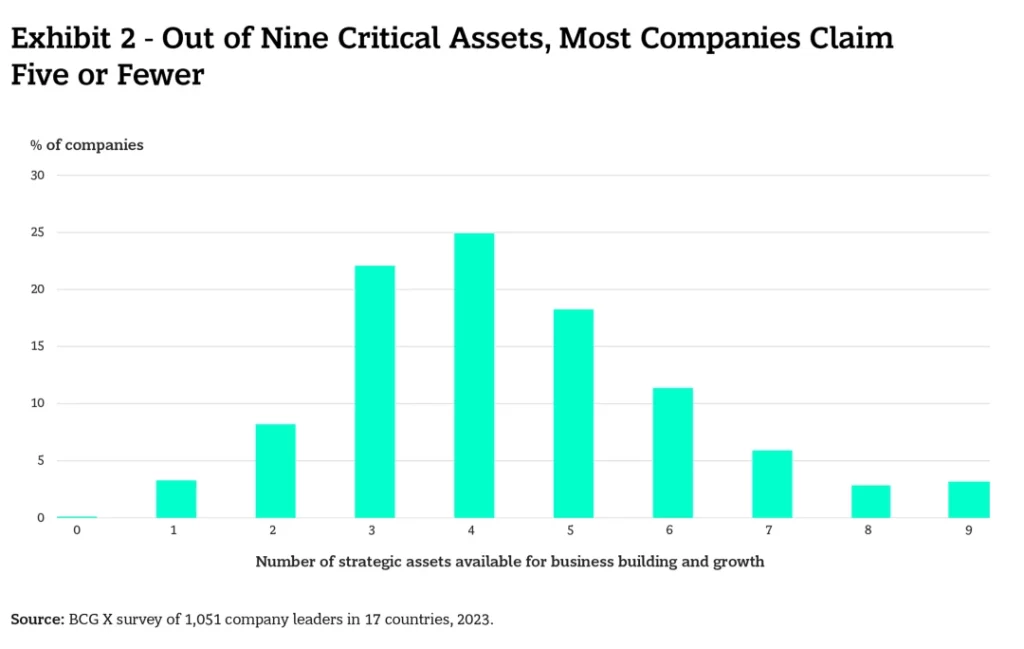

As outlined by Viner – and based on the BCG X’s experience rolling out more than 200 builds – nine strategic assets are viewed as “critically important” in enabling a launch to break through:

According to findings, most organisations have five or fewer of these assets available and only 3% of companies claim access to all of them. Even when they do have the assets, only half of companies are effective in leveraging them to build new businesses.

While most executives label business building initiatives as “successful”, a gap remains between individual efforts and sustained viability – only 52% of companies are well-prepared to pursue new high-growth opportunities.

Despite organisations producing a few new businesses, Viner said they have not developed a “consistent track record” of business building.

“Even after a successful launch, they are not sure they could do it again – and thus they miss opportunities for further expansion,” Viner cautioned. “In short, making business building an immediate priority is no guarantee of long-term success.”

Most generally attributed failures to externally driven factors, such as a poor market fit for their product or service, or the non-viability of the business model. Some also singled out internal clashes over the company’s direction, insufficient available funding, or the inability to recruit essential talent.

“Companies with a record of sustained business building have shown they can address these factors, often in the early stages of a project,” Viner added.

“There are many reasons to be optimistic about business building today, including uptick in technological innovation, consumers’ openness to new products and services, an enormous middle class developing in some emerging economies, and new tools and methods that exist for product development, mergers and acquisitions, and going to market.”

Inform your opinion with executive guidance, in-depth analysis and business commentary.