June 13, 2023

While Nick Lissette does subscribe to the philosophy that fortune favours the brave – continually pushing his business to the limits of innovation and expansion – the adage of “go big or go home” offers a more literal meaning for the Wellington-based entrepreneur.

Through Blackpearl Group, this is a founder scaling overseas operations to new heights in the US while accelerating momentum to realise home ambitions in New Zealand.

“Our most immediate challenge is becoming a more recognised brand in the New Zealand market,” Lissette noted. “Our customer base is US centric – so we can’t leverage our product branding to raise our profile.”

Founded in 2012, Blackpearl acquires and markets data-driven cloud services, including a suite of productivity and demand generation applications for small and medium-sized enterprises (SMEs).

The company acquired US-based email signature marketing platform, NewOldStamp, in November 2022, a matter of weeks before listing on the NZX in December.

All up, the business now runs three software-as-a-service (SaaS) solutions marketed to the SME segment, namely Black Pearl Mail, Pearl Diver and NewOldStamp.

As a serial entrepreneur, Lissette is burning the candle at both ends with a strategy based on building unique product IP and accelerating annual recurring revenue (ARR), in addition to aggressively chasing international and domestic growth.

“Fight hard” on the global stage

Geographically speaking, Blackpearl is driven from Wellington in New Zealand and Tempe Arizona in the US.

For Lissette, the most profound learning during the building of a global business was the realisation that to succeed, a commitment to “properly invest in offshore markets” is paramount.

“If you want to compete, or better still dominate, globally then you’re going to encounter competition with deep pockets and a better understanding of true scale,” he advised.

New Zealand’s Number 8 Wire mentality – a mindset which describes the ingenious and resourcefulness of Kiwis at solving problems – can help close that deficit somewhat, “but it won’t close it fully”.

“I learned that you have to fight hard to get appropriate capital and resources to complete properly,” Lissette added. “Americans tend to understand that much better than New Zealanders – which is why we put a lot of time and energy into getting American investors and talent.”

Tim Crown, chairman of Blackpearl, is a shining example of such commitment paying off, given his standing as co-founder and current chairman of Insight Enterprises – the $10 billion services behemoth listed on Nasdaq as a Fortune 500 technology company.

Add Cherryl Pressley – former senior leader at Microsoft and Google Cloud – to the mix as company director and such experience, drive and market expertise is expected to make a “big impact”.

“Getting Tim on-board changed our company’s destiny,” Lissette shared. “We are constantly learning from him. He’s a visionary in tech and business and is an amazing operator but on a personal level he offers great insights into health, family and fitness – the whole package.”

Historically, circa 65 per cent of revenue has originated from the US, with new product Pearl Diver built specifically for that market.

“It’s flying and the uptake has been tremendous,” Lissette noted. “We can expect that percentage to grow rapidly.”

For any business, scaling up and expanding overseas comes with many challenges, irrespective of industry. According to Harvard Business School, the top five challenges linked to international business are:

Naturally, entering the US from New Zealand renders the first two challenges redundant but nonetheless, entrepreneurs must remain mindful of the potential downsides before embarking on adventures beyond home borders.

“Other than getting a lot less sleep, there haven’t been any direct downsides,” Lissette countered. “I did find that sometimes we had to slow down, in order to speed up though.”

This helped hammer home the importance of getting the basics right and ensuring the correct systems and processes are in place to provide a foundation for future growth. Cumbersome perhaps, but evidently crucial.

Maximise profitability, but don’t stifle growth

Whether building a brand in New Zealand or accelerating ambitions in the US, the top priority for Blackpearl during the next 6-12 months remains anchored around maximising profitability, without stifling growth.

Historically, technology companies were focused on growth at all costs but according to Lissette, the market is now experiencing the negative impact of such an approach given the current economic environment triggering harsh recessionary pressures and mass headcount reductions.

“What it boils down to is that tech companies need to be thinking about money and cash is king,” Lissette said. “Small trades have a significant impact and radically rock our share price, often disproportionate to the size of the trade itself.

“As we continue to grow and become more well-known amongst the investment community, this will stabilise.”

According to recently released unaudited FY23 financials, the company reported revenue of $1.6 million for the year ending 31 March 2023, with total subscription revenue totalling $1.4 million following a 97% year-on-year increase.

A net loss of $7.3 million included one-off expenditures of $1.1 million, associated with the NZX listing, the acquisition of NewOldStamp and the building of Pearl Diver.

“The upside to all of this is the acquisition opportunity for those in the right position, given the contracting valuations on tech companies,” Lissette noted.

The other driver is data, he added.

“Organisations need to know and understand their data and what it’s telling them, in order to make rational, informed decisions based on facts rather than feelings,” he outlined.

Since listing, the business has integrated a new data partner to its proprietary platform – Pearl Engine – which has allowed the rapid productisation of Pearl Diver.

The offering was released to the US market in a staged approach in March, with more than 50 orders during the first month.

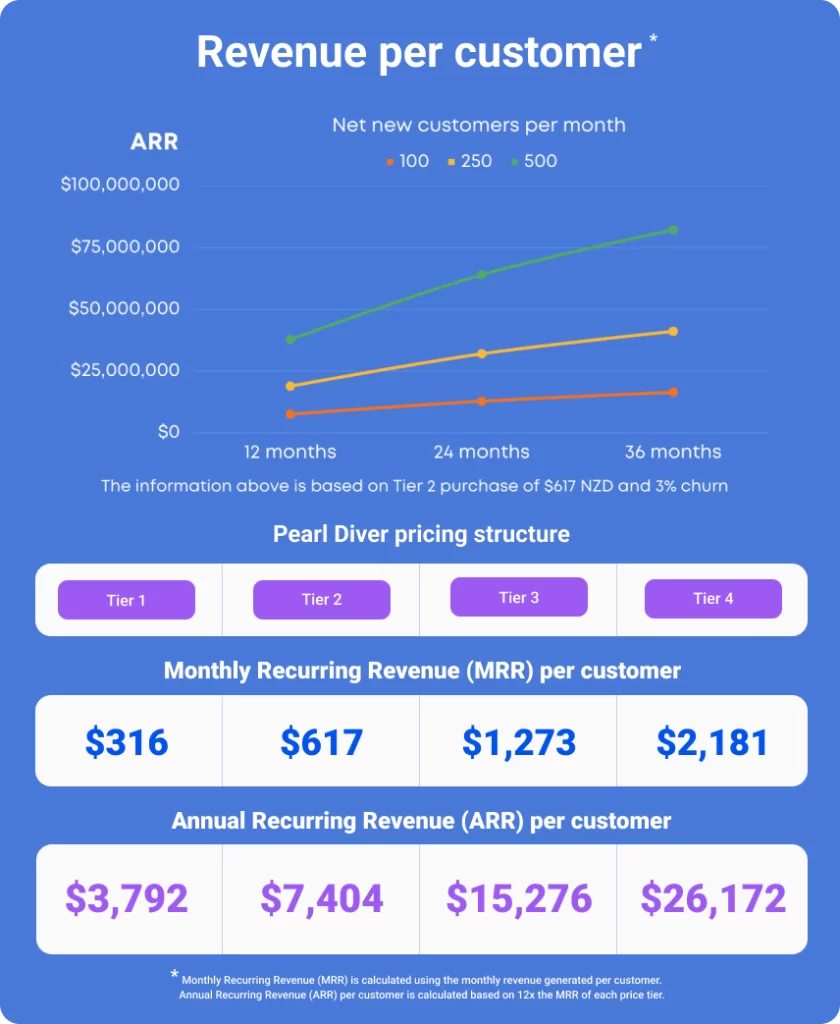

With the average monthly subscription value 10x higher than existing products, the compounding nature of this higher monthly recurring revenue is expected to “significantly impact” the company’s ARR.

“Pearl Diver is a globally unique product,” Lissette noted. “It quite literally shows you who is on your website, how to contact them and who is most engaged. Data insights which point directly to revenue opportunities are critical in this economy. They reduce marketing spend while increasing revenue and sales.”

In May, new sales generated over $280,000 in net new ARR – in addition to already recurring ARR – with an immediate provisioning queue of new customers worth over $56,000 (ARR).

Listing on NZX, acquiring data sets

While accelerating growth represented a key motivation for listing, from a product perspective, Blackpearl is prioritising data and acquisition in the months ahead.

“As a public company we get better access to data streams, which in turn helps us create new features and products – Pearl Diver being a prime example,” Lissette explained. “From an acquisition perspective public stock is far more attractive than private stock.”

Notably, the acquisition of NewOldStamp – together with its broadened lead utilisation from the number of organic site visits – will provide opportunities for Blackpearl to cross-sell, up-sell and increase conversion opportunities across applications.

“NewOldStamp has a great team and revenue, which made them an attractive acquisition in their own right,” Lissette said.

What truly appealed however, was the 1.8 million annual site visits the company receives – a number that would take Blackpearl “years and millions of dollars” to achieve.

“Our acquisition mantra is 1 + 1 = 3,” Lissette added. “This meant getting their talented team and resources, like their organic web traffic, focused on the Pearl Diver product.

“Pearl Diver’s average revenue per customer is at a minimum, 10x that of NewOldStamp. Of course, the NewOldStamp product is still a consistent performer and a great recurring revenue generator.”

Blackpearl has also integrated the NewOldStamp business, allowing scale up with “little to no friction” while tripling the size of development and marketing teams – plus enabling 24/7 global coverage across development, marketing, customer support and sales.

Specific to future acquisitions, Lissette and his team are scouring the globe in search of data sets that are relevant to focus markets such as the US.

“Our acquisition strategy is about much more than simply acquiring technology businesses for their revenue,” he noted. “It’s about gaining access to new talent and markets, and most importantly, accelerating organic growth by getting the right kind of data.”

“Win or die”

To manage the initial capitalisation of Blackpearl, Lissette sold his previous company Silver Cloud – an anti-spam SaaS service founded in 2006 and acquired in 2012 – before bringing a foundation investor on board.

“As soon as I could I went to the US and basically camped there until I got the high-value capital I was looking for,” he recalled.

Acknowledging his endless supply of “war stories” from those early days, Lissette instead wished he’d read ‘Pitch Anything’ by Oren Klaff, a world-renowned expert on helping founders and CEOs optimise and capitalise companies.

“It would have saved me from a world of pain,” he added. “But the attributes of a successful founder have to include tenacity, hustle, ambition, energy and drive, as well as the ability to think big and see the bigger picture.”

At the end of the day however, being a founder is hard work.

“You’re constantly grinding and it can be lonely,” Lissette outlined. “My personal motto and approach to everything I do, to put it bluntly, is ‘win or die’. For some people that’s too aggressive, too single-minded, but to be good at what I do, that’s what works best for me.”

During the preliminary product building stages in 2012, Lissette recognised the value of ensuring his new business operated at the heart of the data game from the start.

“This meant we needed to obtain a breadth and depth of data and email was the natural vehicle for that,” he explained. “Email is the number one business tool in the world today and so email branding and signatures affords you access to a huge amount of data, it’s ubiquitous and used in every country.

“So, we used our first product, Black Pearl Mail, to get data which has then in turn enabled us to grow the Pearl Engine.”

Aligned to the belief that a product company offers scalability at pace compared to a services business, Lissette advised that irrespective of go-to-market model, “you have to go all in”.

“You go big or you go home, so if you’re going to do something, do it properly and give it your all,” he stressed. “Burn the boats so you can’t turn back if it gets hard.”

But as any entrepreneur would attest, bringing everyone else along on the journey during the hard times represents a challenging undertaking.

“No one is going to be as invested as you are as the founder, so you have to put extra energy into stakeholder communications to guide them through the storms,” he noted.

“Often that can be challenging because you have internal battles to fight at the same time. You must really dig deep to find enough energy for everyone.”

Inform your opinion with executive guidance, in-depth analysis and business commentary.