July 31, 2023

The headline-grabbing explosion of artificial intelligence (AI) during the past 6-9 months may have captured enterprise imagination but CEO confidence remains tempered by social, ethical and security risks.

As the dust settles on the rapid rise of generative AI – accelerated by the launch of ChatGPT in late 2022 – market sentiment remains split as organisations weigh up the pros and cons of pursuing such a technology.

“CEO concerns about the unintended consequences of AI reflect a broader confluence of – sometimes dystopian – views in media, society and contemporary culture,” observed Andrea Guerzoni, Global Vice Chair of Strategy and Transactions at EY.

“They see a role for business leaders to address these fears – an opportunity to engage on the ethical implications of AI and how its use could impact key areas of our lives, such as privacy.”

According to EY findings, CEOs remain deadlocked in how best to approach AI.

On the one hand, 65% of executives agree or somewhat agree that AI is a force for good – driving business efficiency and therefore creating positive outcomes for society, such as innovations in health care treatments.

“CEOs clearly see the huge advantages of AI and its potential to drive productivity and positive outcomes for all stakeholders, which has galvanised investment in AI-driven innovation – they know that bold actions to harness the upside potential will lead to future competitive advantage,” Guerzoni added.

Alternatively however, 65% also believe more work is needed to address the social, ethical and criminal risks inherent in the new AI-fuelled future – from cyber attacks to disinformation and deepfakes.

Within that context, 66% of CEOs believe the impact of AI replacing humans in the workforce will be counterbalanced by new roles and career opportunities that the technology creates.

“Government policymakers and regulators have a significant role to play in establishing rules and guardrails for how generative AI is used,” Guerzoni said. “And CEOs also see a role for the business community to engage much more on the ethical implications of AI and the impact of its use on key areas of our lives, such as privacy.”

AI dominates dealmaking process

As outlined via The CEO Outlook Pulse – which surveyed more than 1,200 CEOs across a range of industry sectors – despite such concerns, executives continue to adapt investment strategies to maximise the benefits of AI.

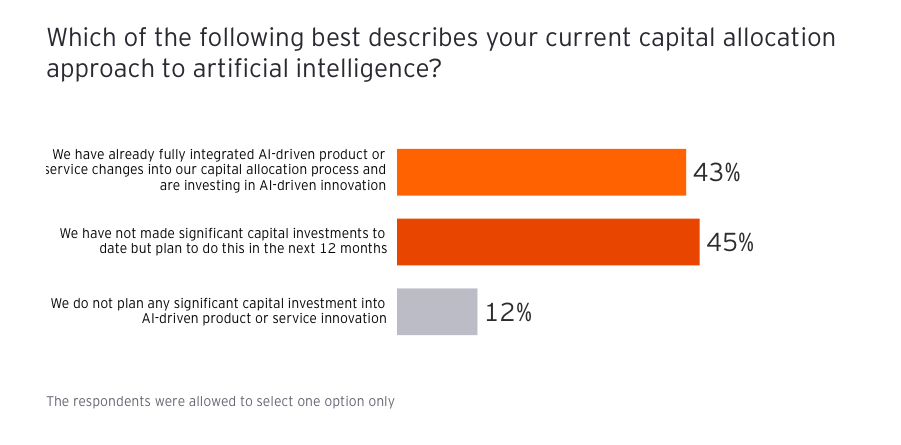

Notably, a significant majority of CEOs (88%) are integrating AI into their capital allocation. Currently, 43% are actively investing in the technology while the 45% are planning to make significant investments in AI during the next 12 months.

CEOs are also incorporating AI into mergers and acquisitions (M&A) strategies – leveraging these technologies in deal sourcing and processing.

According to findings, 71% are incorporating AI into the transaction process, either significantly or through pilot programs while only a small cohort (5%) have no plans to use AI – and they risk being outmanoeuvred by the competition.

“Despite economic headwinds, accelerating technology innovation and continued disruption, CEOs want to get on the offensive and many are looking at deals to make that happen,” Guerzoni noted.

“The future of M&A dealmaking means significantly more information needs to be captured, processed, analysed and interpreted than ever before. Traditional means are no longer effective in delivering a competitive edge. AI capabilities, deployed correctly, may be the key to unlocking even more value through M&A.”

More broadly speaking, dealmaking in general remains a priority for CEOs. Nearly all (98%) of CEOs expect to actively pursue a strategic transaction in the next 12 months (up from 89% in January 2023), with 59% looking to M&A, 47% looking to divest and 63% looking to enter strategic alliances or joint ventures.

“The appetite to acquire is close to a record high but barriers to doing deals in the current market such as increasing regulation and a higher cost of capital will likely temper many of these plans,” Guerzoni added.

As noted by EY, improving technology capabilities and innovation is a primary driver of M&A, with 16% of CEO stating that this a primary investment goal.

Inform your opinion with executive guidance, in-depth analysis and business commentary.