August 14, 2023

Cloud investment in Asia Pacific is outpacing key geographies across the world as the region increases enterprise spending in both established and emerging markets.

Signalling a collective step-change in approach, nations with varying levels of maturity are recognising the potential of either accelerating or embracing cloud-based solutions and services – spanning public cloud, private cloud and hybrid cloud environments.

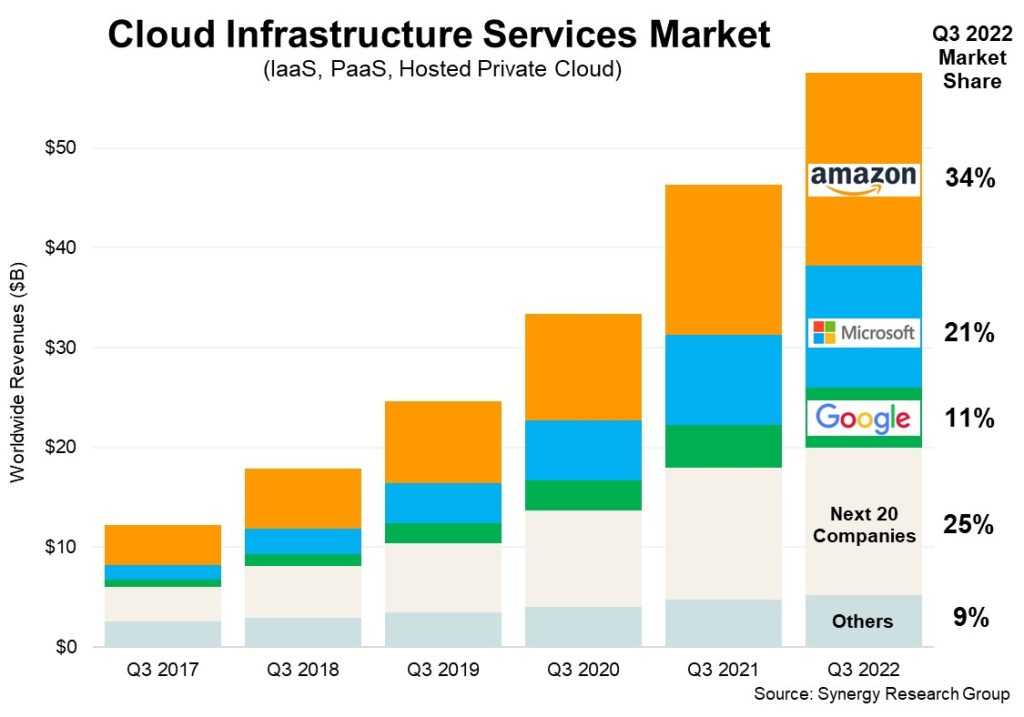

According to new data from Synergy Research Group, enterprise spending on cloud infrastructure services approached US$65 billion worldwide during the second quarter of 2023, up by $10 billion from the same period last year.

Representing the third successive quarter in which the cloud market grew by $10 billion compared to 2022, global year-on-year growth rate totalled 18% during the three-month period. This was down in comparison to the 19% in the previous quarter and 20% in the fourth quarter of 2022.

However, second quarter spending was up by 3% compared to the first quarter – considered similar to the quarter-on-quarter growth rate seen during the same period last year.

Notably for Asia Pacific – and when measured in local currencies – Australia, China, India and South Korea stand tall as crucial engines for growth with each reporting “well over” 20% year-on-year growth in spending during the second quarter. All four nations outpaced global market growth during this period.

But business enthusiasm for cloud is now found in almost all developed and developing countries in the region, triggered by heightened hyperscaler interest in Indonesia, New Zealand, Thailand and Malaysia among others.

“The current economic climate has crimped some growth in cloud spending but the market continues to expand at a healthy rate despite those short-term challenges,” said John Dinsdale, Chief Analyst at Synergy Research Group.

According to Dinsdale, the growth rate in cloud spending continues to “nudge down”, largely driven by macroeconomic pressures, some belt-tightening by enterprises, local market issues in China – and above all else – the law of large numbers.

“While growth rates are coming down, in absolute terms the quarterly market keeps on growing by $10 billion from last year,” he explained.

“With the Chinese market potentially returning to somewhat more normal circumstances, many economic pressures easing, and enterprises having rationalised historic cloud usage and spending, Synergy expects future cloud growth rates to remain buoyant.”

From a vendor standpoint, Google Cloud and Microsoft reported the stronger year-on-year growth numbers, with both increasing worldwide market share by a percentage point from the second quarter of last year at 11% and 22% respectively.

As noted by Synergy, market leader Amazon Web Services (AWS) stayed within its long-standing market share band of 32-34%, though towards the bottom end of that range.

“In aggregate the three leaders accounted for 65% of the worldwide market,” Dinsdale noted.

Among the tier-2 cloud providers, those with the highest year-on-year growth rates include Oracle, Snowflake, MongoDB, VMware, Huawei and China Telecom.

With most of the major cloud providers having now released earnings data for the second quarter, Synergy estimates that quarterly cloud infrastructure service revenues totalled $64.8 billion, with trailing 12-month revenues reaching $247 billion. This includes infrastructure-as-a-service (SaaS), platform-as-a-service (SaaS) and hosted private cloud services.

“Public IaaS and PaaS services account for the bulk of the market and those grew by 19% in the second quarter,” Dinsdale added. “The dominance of the major cloud providers is even more pronounced in public cloud, where the top three control 72% of the market.”

Inform your opinion with executive guidance, in-depth analysis and business commentary.