September 18, 2023

Amid carbon-copy media headlines highlighting projected single digit growth in overall Australian IT spending during 2024, the real story of interest is emerging in the data centre.

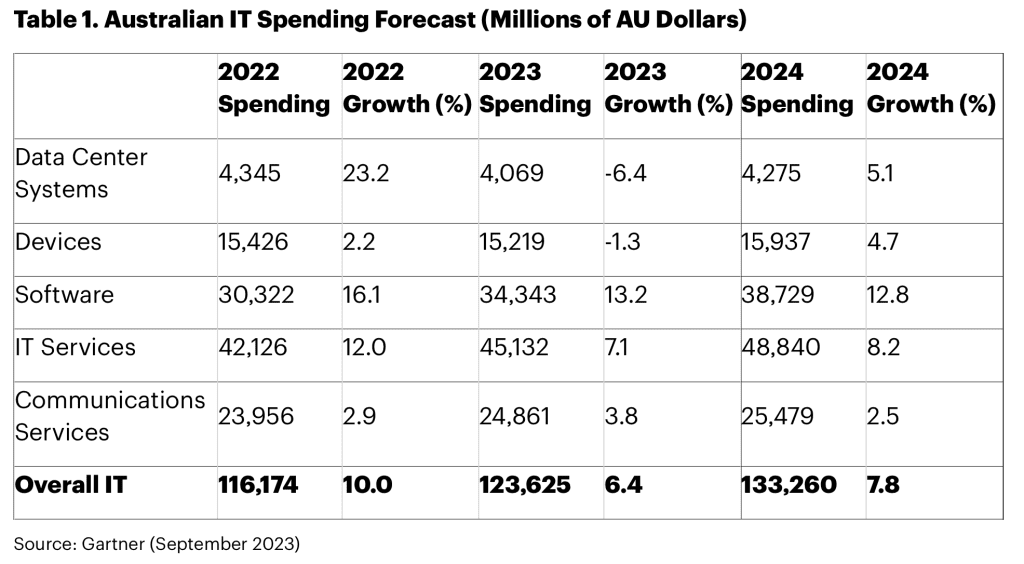

Investment in this segment of the market is expected to reach approximately $4.28 billion within the next 12 months, representing 5.1% growth year-on-year.

According to Gartner, this is compared to $4.07 billion in 2023 which experienced slower growth and a 6.4% decline following double-digit spending in 2022 – $4.35 billion at 23.2% growth.

From a 6.4% decline, Gartner now forecasts this will rebound to 5.1% growth in 2024.

“This turnaround in spending on data centre systems next year in Australia will primarily be driven by increased investments in secure access service edge (SASE) technologies,” observed Andy Rowsell-Jones, Vice President Analyst at Gartner.

Speaking at Gartner IT Symposium/Xpo on the Gold Coast, Rowsell-Jones said local CIOs consider SASE as a top two technology investment priority, alongside generative AI.

The focus on SASE is motivated by a desire to “simplify the delivery of critical network and security services via the cloud”.

Overall, IT spending in Australia is projected to exceed $133 billion in 2024, an increase of 7.8% from 2023.

According to Rowsell-Jones, such projected growth – in the context of an anticipated inflation rate decline to around 3.25% by the end of 2024 – suggests that more money will be available to IT departments.

“Despite this, most Australian CIOs are focused on optimising infrastructure and operational costs and efficiencies, by further investing in cloud and digital enablement to deliver higher business outcomes and revenue,” he added.

Data centre investment forecasts in Australia mirror analyst observations that in the current economic climate, IT infrastructure is unlikely to rank as a major challenge for enterprise-levels organisations.

“This won’t be a year to realise grand ambitions but it marks a moment to refocus, retool and rethink your infrastructure,” said Paul Delory, Vice President Analyst at Gartner. “In every crisis lies opportunity, and in this case, the chance to make positive changes that may be long overdue.”

Addressing CIOs at Gartner’s IT Infrastructure, Operations & Cloud Strategies Conference in Sydney in May, Delory cited four leading cloud, data centre and edge infrastructure trends currently shaping investment plans.

While public cloud usage is almost universal, Delory said many deployments are ad hoc and poorly implemented.

As a result, Delory said infrastructure and operations (I&O) teams have an opportunity to revisit hastily assembled or poorly architected cloud infrastructure to make it more “efficient, resilient and cost-effective”.

“The focus of refactoring cloud infrastructure should be on optimising costs by eliminating redundant, overbuilt or unused cloud infrastructure; building business resilience rather than service-level redundancy; using cloud infrastructure as a way to mitigate supply chain disruptions and modernising infrastructure,” he explained.

According to Gartner, 65% of application workloads will be optimal or ready for cloud delivery by 2027, up from 45% in 2022.

Delory said I&O teams are continually challenged to meet new and growing demands with new types of infrastructure. This includes edge infrastructure for data-intensive use cases; non-x86 architectures for specialised workloads; serverless edge architectures and 5G mobile service.

As a result, Gartner predicts 15% of on-premises production workloads will run in containers by 2026, up from less than 5% in 2022.

For Delory, I&O professionals must now evaluate alternative options with care, focusing on their ability to “manage, integrate and transform” in the face of constraints on time, talent and resources.

“Don’t revert to traditional methods or solutions just because they’ve worked well in the past,” Delory advised. “Challenging periods are times to innovate and find new solutions to meet business demands.”

According to Delory, data centres are shrinking and migrating to platform-based colocation providers.

Combined with new as-a-service models for physical infrastructure, this can bring cloud-like service-centricity and economic models to on-premises infrastructure.

According to Gartner, 35% of data centre infrastructure will be managed from a cloud-based control plane by 2027, from less than 10% in 2022.

“I&O professionals should focus this year on building cloud-native infrastructure within the data centre; migrating workloads from owned facilities to co-location facilities or the edge; or embracing as-a-service models for physical infrastructure,” Delory added.

In Australia, a lack of skills remains the biggest barrier to infrastructure modernisation initiatives, with many organisations finding they cannot hire outside talent to fill these skills gaps.

“IT organisations will not succeed unless they prioritise organic skills growth,” Delory cautioned. “I&O leaders must make operations skills growth their highest priority this year.

“Encourage I&O professionals to take on new roles as site reliability engineers or subject matter expert consultants for developer teams and business units.”

Gartner predicts 60% of data centre infrastructure teams will have relevant automation and cloud skills by 2027, up from 30% in 2022.

Future investment plans in Australia

Beyond the data centre, Australian CIOs are expected to direct the largest amount of new or additional funding in 2024 towards cyber security, cloud platforms, data and analytics and application modernisation.

Notably, spending on software will see the largest growth with an increase of 12.8% expected.

“Given the highly publicised data breaches we’ve seen in Australia over the past 12 months, it’s no surprise that cyber security is at the top of the spending list again,” Rowsell-Jones added.

“Every organisation’s risk and audit committee is worrying about a potential cyber security fallout and various industry regulators are actively pushing for improved capabilities.”

Of note to the technology ecosystem, IT services is expected to remain the largest IT spending category in Australia, forecast to reach over $48.8 billion in 2024.

For Rowsell-Jones, this will primarily be driven by the increased use of consulting services and infrastructure-as-a-service (IaaS).

This represents an increase of 8.2% from 2023, reflecting the increasingly important role managed service providers (MSPs) play in helping organisations in Australia navigate emerging digital opportunities and challenges.

“Interest in digital is undiminished but Australian organisations have become more realistic in their attitudes to it,” Rowsell-Jones noted.

“Rather than trying to become the next digital giant, organisations are investing in digital enablement, either to improve cost and operational efficiencies, or to augment a traditional product set with digital capabilities so they can offer more services.”

Specific to generative AI, this technology will primarily be incorporated into enterprises through existing spending in the long-term, through software, hardware and services already in use.

“Generative AI tools are reducing the barriers to entry for software development, which means more digital capabilities are now lying outside the core IT organisation,” Rowsell-Jones outlined.

“Australian CIOs should harness this capability and provide the guardrails to support and facilitate business technologists in the wider organisation.”

Inform your opinion with executive guidance, in-depth analysis and business commentary.