August 10, 2023

New Zealand should be experiencing “tangible progress” on the “great rebalancing” following a period of tightened monetary policy, yet concerns remain as operating margins continue to increase.

“Several imbalances are clearly evident in the New Zealand economy,” noted Kelly Eckhold, Chief Economist at Westpac. “Most fundamentally, while growth is slowing, the economy is running above its sustainable capacity and inflation is still very high.

“This is partly why the current account deficit remains very large. Meanwhile, the fiscal position remains in the red despite the unemployment rate sitting near historical lows.”

As outlined by Eckhold, the Reserve Bank of New Zealand (RBNZ) has “appropriately” tightened monetary policy to improve balance between demand and the economy’s productive capacity.

“Given the marked tightening of monetary policy over the past couple of years, we are now in the period where we should be starting to see tangible progress on the ‘great rebalancing’,” he added. “The key question is how fast will this rebalancing occur?”

According to Westpac Economic Overview (August 2023) findings, encouraging early signs exist in New Zealand with inflation now off its highs, at least on a headline basis. In addition, consumer spending has been weakening as households have tightened their belts as interest rates and other cost of living pressures bite.

“But there are also areas of concern,” Eckhold cautioned. “Notably, domestic inflation hasn’t fallen as fast as expected.

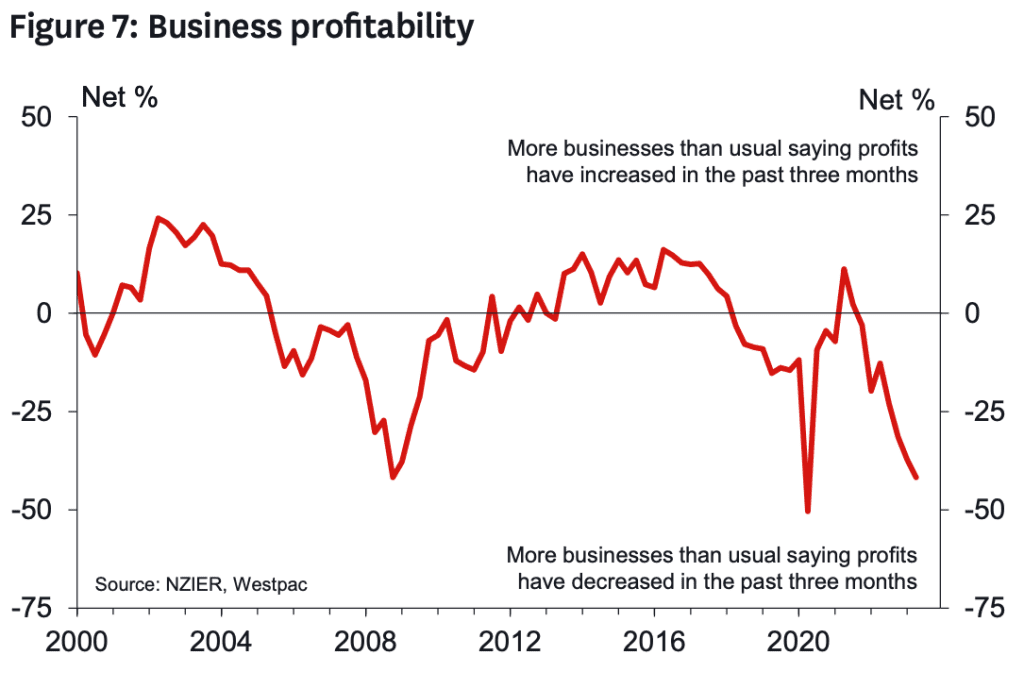

“The fiscal position is not improving as falling profitability is undermining business tax revenue and means the government is not currently assisting with the required rebalancing – its contribution may come in future years.

“And while the current account deficit has begun to narrow, it will likely remain elevated compared to pre-pandemic levels.”

As a consequence, Eckhold advised that further monetary policy action is required to ensure that inflation will fall in a timely manner. This is likely to also trigger a further increase in the Official Cash Rate later this year and only gradual rate reductions down the line.

“We’re forecasting a protracted period of sub-trend economic growth,” Eckhold shared.

“For inflation to fall as quickly as the RBNZ has forecast, a softening in the labour market is needed and wage growth needs to slow. If that doesn’t happen, there’s a risk that the Official Cash Rate will need to rise even further than we’re projecting.”

Margin pressures continue as election looms

According to Westpac, a common theme across all sectors is pressure on operating margins in New Zealand.

While some of the large cost increases experienced at the height of the pandemic have eased – such as transport and shipping costs – most businesses continue to report sizeable rises in operating expenses.

“The past year has seen particularly large increases in staffing costs, with average wage rates rising by around 6% to 7%,” Eckhold added.

“In addition, financing costs have been rising as interest rates have pushed higher. Cost pressures have been especially strong in the agricultural sector (up 12% over the past year) and in the construction sector (up 9%).”

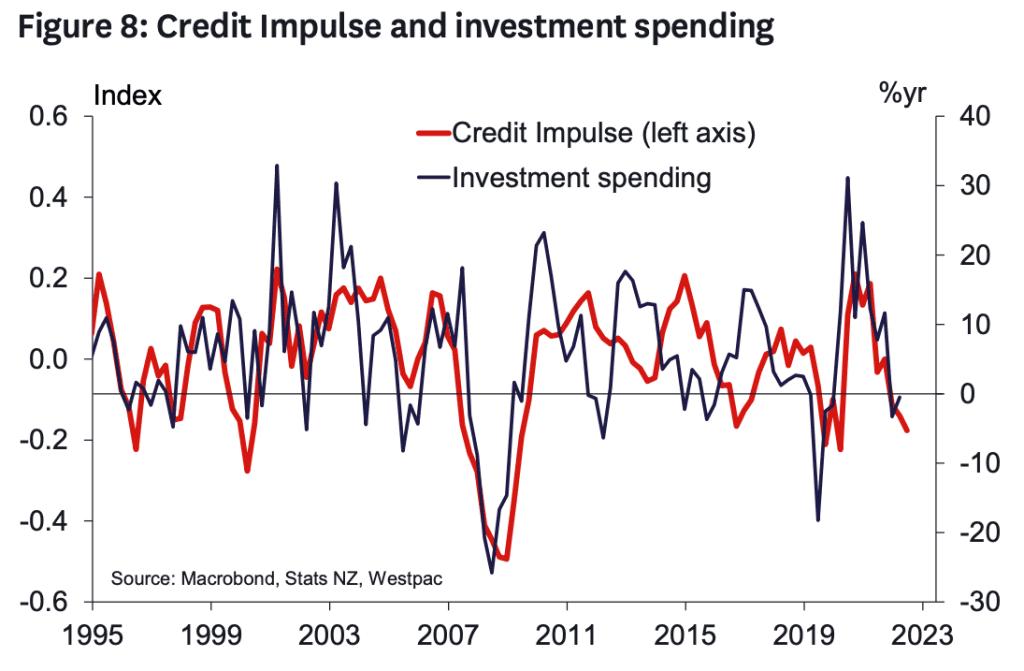

With profit margins being squeezed and interest costs pushing higher, Eckhold said businesses have scaled back plans for capital expenditure.

“That’s seen system-wide lending to the business sector slowing from over 9% per annum last year to just 3% now,” the report stated. “Investment intentions have fallen especially sharply in the manufacturing and construction sectors.”

According to Eckhold and his team of economists, one of the factors that will shape the economic landscape over the coming years will be the outcome of October’s election.

“At the time of writing, polling between the two sides of the aisle remains close,” he noted. “And while polls suggest we’re almost certain to see a shift to some form of coalition government, its make-up, and whether it’ll be left or right of centre, isn’t clear.”

Following the election, the market could see changes in some important policy areas, including to the tax system and environmental policies.

“New Zealand will face some tough fiscal decisions,” Eckhold warned. “Back in May, the 2023 Budget already pointed to mounting pressure on the government’s finances, with the Treasury pushing out the time it’s expected to take for the operating balance to return to surplus by one year to 2026.

“We think the pressure on the government’s finances could be even starker than the Treasury expected in May. Tax revenue over recent months is already falling behind Budget forecasts.”

On this basis, and factoring in weaker outlook for nominal GDP growth (and hence the tax base), Westpac anticipates that the 2023 and 2024 operating balances are likely to be a combined $9 billion below the Treasury’s Budget 2023 forecasts.

Inform your opinion with executive guidance, in-depth analysis and business commentary.