June 22, 2023

Failure to demonstrate sustainability capabilities and credentials will exclude outsourcing partners from winning new enterprise-grade contracts, as the top end of town gets serious on the environment.

Set to become the leading quality that organisations seek from vendors and partners, “sustainable by design” solutions will swing the balance on future emerging technology investment projects.

The shift in focus essentially relegates competitive pricing, end-to-end solution capabilities and customisable offerings to the level of table stakes – significantly important but soon to be presumed as industry standard.

According to EY, 76% of enterprises now view environmental, social and governance (ESG) as “leading or important considerations” when assessing new solutions, whether 5G, Internet of Things (IoT) or edge computing.

So much so that 77% of CIOs will prioritise emerging tech vendors that can articulate the environmental impact of projects deployed.

“Sustainability and broader ESG goals are very much at the heart of enterprises’ relationship with technology,” noted Tom Loozen, Global Telecommunications Leader at EY.

With sensitivity to the environmental impact of technology choices at an all-time high, 74% of end-user executives are building stronger links between sustainability and digital transformation plans.

No longer is this an innovate at all costs mentality, rather an intentional commitment to convert ESG rhetoric into results – as noted in latest edition of the EY Reimagining Industry Futures Study.

“Sustainability is set to become the dominant factor informing technology vendor decisions,” Loozen said.

“To keep pace, CIOs must do more to ensure that high levels of expectation translate into long-term value creation by working with leadership teams to make sustainability a guiding principle that defines vendor relationships.

“Equally, vendors must play their part, going further to reflect sustainability in their offerings and doing more to sufficiently address ESG considerations through use cases.”

As outlined by EY, the top five most important vendor / partner attributes sought by CIOs today span:

Yet for an ecosystem motivated by winning additional business and acquiring net new logos, the rules of engagement are changing. While outsourcers appear safe from losing current contracts due to a lack of sustainability focus, this will torpedo any chance of success during future tender processes.

Below are the top five most important future vendor / partner attributes sought by CIOs:

Mixed views on ecosystem competencies

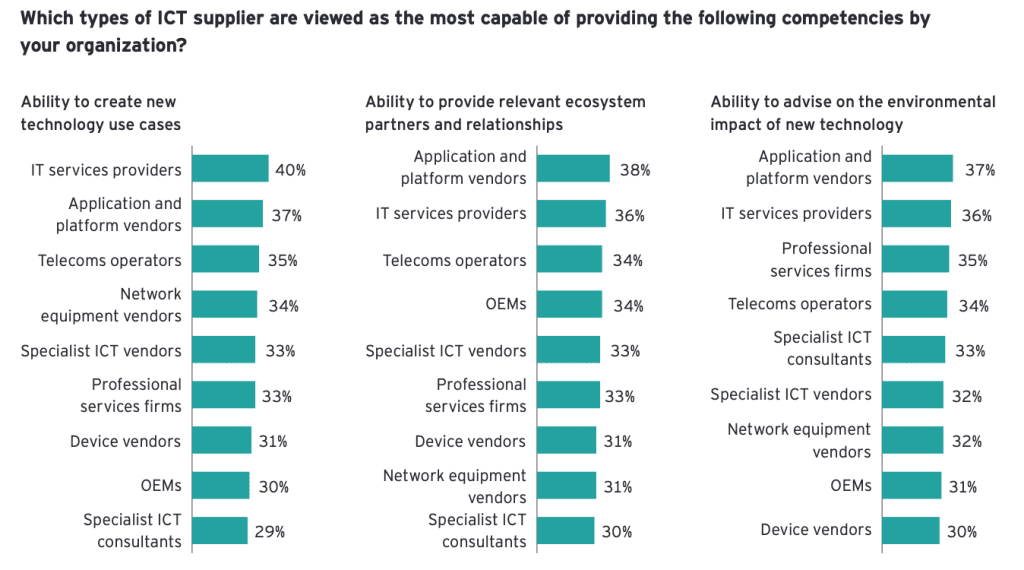

Despite demanding sustainable capabilities and credentials, CIOs remain unsure as to which segment of the ecosystem can best advise on the environmental impact of new solutions.

“Enterprises have mixed views on supplier competencies but rank IT services providers and application vendors ahead of the rest,” Loozen noted.

While not exactly a glowing endorsement, 37% of executives view application and platform vendors as the best source of guidance, ahead of IT service providers (36%) and professional services firms (35%).

This is followed by telecoms operators (34%), specialist consultants (33%), specialist vendors (32%), network equipment vendors (32%), original equipment manufacturers (OEMs) (31%) and device vendors (30%).

“There are no dominant leaders when it comes to the perceived ability of different suppliers to create use cases, provide ecosystem relationships or advise on the environmental impact of new technology,” Loozen explained.

“There is more variation in sentiment between industries. For example, specialist technology vendors score top for environmental advice among energy companies and rank second as use case creators among consumer industry respondents.

“Encouragingly for telcos, government respondents see them as best placed to provide relevant ecosystem partners and relationships.”

An area in which ecosystem expertise shines a little brighter is digital transformation, with professional services firms leading the charge (55%). Application and platform vendors (44%) are in pursuit, in addition to IT service providers (39%) and network equipment vendors (32%).

“Technology providers that can clearly articulate their role within industry ecosystems have an edge in the marketplace,” Loozen advised.

Specifically, 53% of organisations would prioritise such a provider in Asia Pacific.

“Businesses also believe that ecosystem collaboration can extend into new domains,” Loozen added. “80% think cross-industry collaboration on circular economy business models will become much more important in the next five years.”

Delivering “sustainable by design” tech

The perceived benefits of emerging tech – combined with a sustainable ecosystem – are primarily viewed as helping to accelerate reduced energy consumption (46%), as well as improving impact measurement (39%) and target planning (39%).

Other key positives include the reduction of waste production (39%), enhanced supplier chain or supplier emissions visibility (38%) and increased levels of recycling (37%), in addition to providing virtual services and workforce tools (both on 36%).

The majority (54%) of organisations expect emerging tech to help achieve such benefits, which is notably higher (62%) among CIOs in Asia Pacific.

Specific to technology, ESG ranks as a “leading or important consideration” when investing or planning 5G projects (81%), followed by artificial intelligence (AI) and analytics (79%), robotics and automation (79%), IoT (77%) and edge computing (66%).

Notably, 47% of CIOs believe 5G and IoT use cases in particular must be “sustainable by design” to adequately address evolving environmental requirements.

“As enterprises become more attuned to the opportunities that 5G and IoT offer in driving growth, vendors must proactively respond to evolving use case demands,” added Adrian Baschnonga, Global Lead Analyst of Technology, Media and Telecommunications (TMT) at EY.

“Critical to this agenda is effectively mapping solutions to changing business needs, while also harnessing 5G and IoT with other technologies such as artificial intelligence and edge computing to maximise their collective impact.”

Inform your opinion with executive guidance, in-depth analysis and business commentary.