February 7, 2024

As Indonesia wakes up from the elongated economic slumber that was COVID-19, the nation transitions from recovery to growth mode amid the backdrop of heightened technology interest.

Like many other neighbouring nations, the largest economy is Southeast Asia is attempting to ignite an innovation flame in the pursuit of fiscal growth, market competitiveness and nationwide prosperity.

Throw in the Presidential Election on 14 February – in which approximately 205 million people will be eligible to vote in one of the largest elections on the planet – and 2024 is shaping up to be a year of sizeable change for the archipelago.

Amid such change, organisations of all shapes and sizes are executing enhanced strategies in a bid to capitalise on the opportunities ahead – using technology as a tool to expand market share.

But is this a nation serious about full-scale transformation?

Leading figures of authority within the technology ecosystem in Indonesia – managed service providers (MSPs), software specialists, system integrators (SIs) and value-added resellers (VARs) – tackled the question head-on to assess the state of Indonesia in 2024 and beyond.

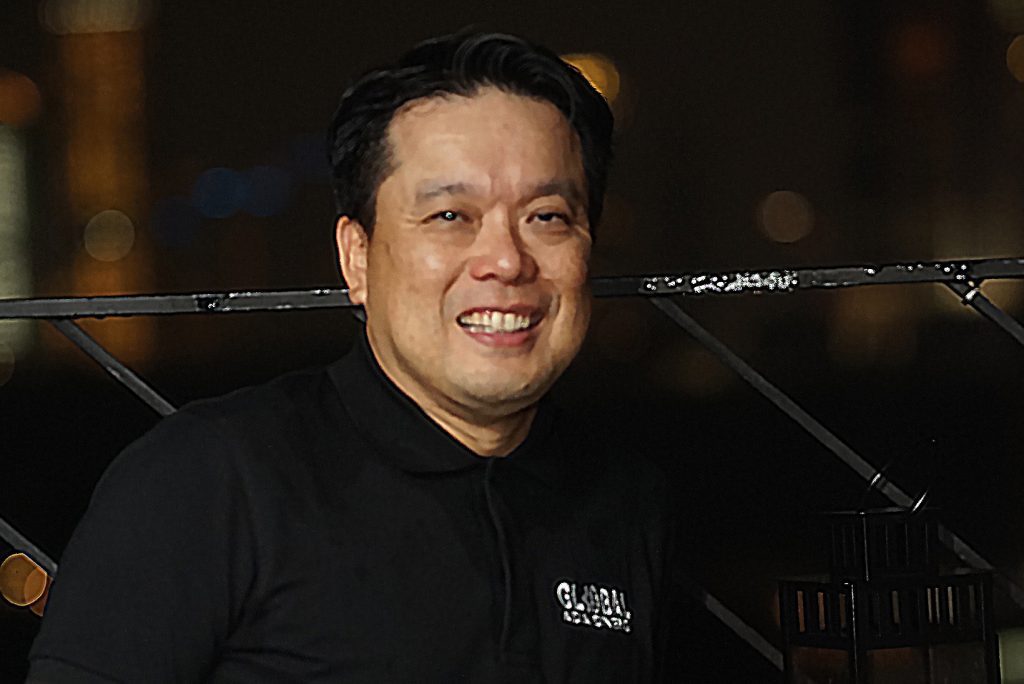

“Indonesia has shown a growing appetite for innovation in recent years,” observed Sim Bong, Director of Operations and Marketing at Global Asia Sinergi. “This has primarily been driven by factors such as rising incomes, technological advancements and improved awareness of the potential benefits of innovation.”

According to the World Bank, Indonesia’s economic growth remains resilient, with inflation on a declining trend and national currency considered stable.

As outlined via Indonesia Economic Prospects report, gross domestic product (GDP) growth is projected to ease slightly to an average of 4.9% during the next three years until 2026, down from 5% in 2023 as the commodity boom loses steam.

“Indonesia has a track record of navigating shocks and maintaining economic stability,” said Satu Kahkonen, Country Director of Indonesia and Timor-Leste at World Bank. “The challenge for the country is to build on strong economic fundamentals to deliver faster, greener and more inclusive economic growth.”

To achieve such growth, Kahkonen stressed the importance of continuing to implement reforms that remove bottlenecks that limit efficiency, competitiveness and productivity growth.

“Doing so will enable Indonesia to accelerate growth, create more and better jobs and achieve its vision of becoming a high-income country by 2045,” Kahkonen advised.

Within the next 12 months however, private consumption is anticipated to be the primary driver of growth. Business investment and public spending are also expected to pick up as a result of reforms and new government projects.

“Indonesia, alongside many other ASEAN countries, continues to prioritise innovation as a key driver of economic growth and development,” Sim Bong added.

“Governments and businesses have been investing heavily in areas such as digital infrastructure, research and development [R&D] and start-up ecosystems. This is to foster innovation and entrepreneurship.”

The ripple effect has been enhanced enthusiasm from a private sector encouraged to capitalise on a range of technological advancements taking place across multiple sectors.

“Even though the economy slowed down during the pandemic, it accelerated the exploration of new areas such as work-from-home, e-commerce, financial institutions, healthcare and logistics among others,” noted Ts. Saravanan Belusami, CEO of VADS Indonesia.

Overcoming cost challenges

As technology returns to the boardroom agenda item, Belusami cited the importance of leveraging new solutions to improve cost optimisation. In a tough economic market, the ability to save cash becomes mission-critical.

“This is a pertinent matter,” he acknowledged. “The cost of operations can go down by replacing humans with automation. The dependency on human work can be reduced and technology can be programmed to run for 24 hours while humans obviously have limitations.”

The promise of heightened productivity and efficiency should not be discounted as well, Belusami added.

“It’s undeniable that the tolerance level for making a mistake would reduce,” he advised. “This would improve customer experience also through the use of chatbots, AI [artificial intelligence] and RPA [robotic process automation] technologies etc. Using technology as a service differentiator is a new way for companies to conquer the market.”

Building on the comments of Belusami, Sim Bong shared that personalised and seamless customer experiences have become commonplace expectations nationwide, triggering a change in investment from organisations seeking to improve user engagement across multiple channels.

“Improving operational efficiency is also key,” he said. “Many organisations are leveraging technology to streamline operations and processes, reduce costs and increase productivity.”

Not every company challenge is internally focused however – digital transformation is naturally a key priority for growth-hungry organisations seeking to capitalise on emerging market opportunities.

“Technology is seen as a critical enabler of this transformation, enabling organisations to digitise operations, products and services,” he explained.

“With the volume and complexity of data growing rapidly, investment in technology is increasing to manage and analyse data effectively. This includes tools for data visualisation, predictive analytics and machine learning.”

The creation of new products and services – underpinned by revamped business models – is also kick-starting market interest in emerging technologies such as AI, blockchain and the Internet of Things (IoT) among others.

Echoing such a shift in focus is Untag Pranata, CEO of Unzyp Software. The Jakarta-based software specialist has experienced a “significant development” in technology demand post-pandemic, notably in AI and blockchain.

“In Indonesia, blockchain technology remains a fascinating topic and has the potential to drive the digital economy,” Pranata stated. “Alongside the ground-breaking innovation of AI through the emergence of ChatGPT from OpenAI, both offerings will play a vital role in determining the technology roadmap from now until 2030.”

Tackling security head-on

Wrapped up in the promise of innovation however is the sobering reminder that cyber security remains a leading cause for concern in Indonesia.

According to Kroll findings – State of Incident Response: Asia Pacific – more than half of Indonesian businesses (52%) have experienced a cyber incident of some capacity, just under the Asia Pacific average of 59%.

Data loss is the primary concern (82%), followed by reputational damage (70%) – which is the highest in the region – and business interruption (62%).

“There is a challenge in managing data security,” Pranata accepted. “The Indonesian Government recently issued the Personal Data Protection Law in 2022, which requires organisations to secure user data. But most organisations are not implementing best practices for data security.”

Speaking from experience as a leading Microsoft partner in market, Pranata outlined that the majority of local companies embraced the cloud during COVID-19 but failed to implement robust security measures in parallel.

To address such a gap, the Indonesian Government has mandated ISO 27001 certifications for all state-owned companies.

“Naturally, this market opportunity has led to the emergence of numerous technology service providers in Indonesia that offer security and blockchain technologies,” Pranata added.

While most mature organisations understand the importance of operating secure IT environments, Yohan Gunawan – Director of Multipolar Technology – challenged that adoption and prioritisation both remain alarmingly low.

“Presumably that’s because of the difficulties in calculating perceived ROI [return on investment] in cyber security,” he questioned. “All businesses invest in cyber security and then expect that nothing will happen. But the biggest threat is not knowing that everyone is also personally responsible for securing information.

“Breaches always start from the weakest points in the system, of which most are stolen credentials or yet to be patched well-known vulnerabilities. It’s disappointing as these two issues can easily be taken care of.”

Offering a glimpse of positivity however, Belusami accepted that despite increased levels of risk and exposure, organisations are “taking steps” to enable firewalls and build defences around core networks and applications.

Kick-starting innovation plans

When assessing the technologies capable of driving large-scale transformation, Gunawan said that despite ongoing organisational interest in cloud migration, “only a select few understand the true benefits of adoption”.

“These are start-ups that leverage OPEX models with an ability to start small and scale at speed as requirements evolve,” he added. “The next group of companies will embrace cloud for flexibility purposes while the remainder of the industry will remain in the ‘wait and see’ camp.”

Solidifying his point, Gunawan cited “flexibility and availability” as the leading features of cloud that are capturing the attention of Indonesian organisations.

“They are difficult features to maximise in on-premises environments,” he noted. “From our engagement we have deployed DevOps and DevSecOps to support mobile application developments which are the driving force behind most cloud adoptions. Besides this, ERP [enterprise resource planning] migration plans to the cloud are also underway.”

As a well-established IT system integrator – specialising in hybrid multi-cloud infrastructure – Multipolar Technology is continuing to build capabilities in cloud and cyber security.

“We anticipate that every enterprise organisation will adopt a secure hybrid multi-cloud environment,” Gunawan added.

“On-premises solutions have pros and cons, as do the solutions offered by the hyperscalers. We must help customers combine the best of each solution while also securely connecting the network to the hybrid infrastructure.”

In the local market, Multipolar Technology differentiates through providing an “integrated solution” capable of meeting evolving end-user demands.

“We initially thought cloud would be competitive to our on-premises solutions,” Gunawan shared. “But, at least to this date, cloud will not replace on-premises solutions completely, both have a purpose and benefit.”

Specific to AI and automation, Sim Bong referenced increase usage to primarily improve business processes, reduce costs and enhance customer experience levels.

“Many organisations are exploring the potential of these technologies to gain a competitive edge and drive innovation,” he noted. “Indonesia is a rapidly growing market with a large population and many companies still remain in the early stages of adopting IT services.”

After launching Global Asia Sinergi in 2012 with four employees and a sole product line in the form of Kaseya, the business now houses more than 20 staff and offers approximately eight solutions to customers across Asia.

Within this context, and in assessing the next 6-12 months, Sim Bong outlined four key business priorities:

According to Sim Bong, such changes are expected to lay the groundwork for “short-term” expansion in the areas of cloud-based IT service management, asset management and operations.

Similarly, Belusami said the common conversation on the topic of efficiency and productivity also extends to RPA, big data and analytics – “the enablement of digital is unavoidable”.

In response, Belusami said VADS Indonesia must operate with a “good understanding” of the technologies available in the market, especially in the highly competitive business process outsourcing (BPO) industry.

“This means we must offer a range of services from traditional to digital, plus back-office and smart services etc,” he noted. “By focusing on the right technology enablement and choice of vendor or partner, we can create market-leading services.”

For Belusami, this can be distilled into three leading priorities:

Meanwhile, and during the past two years, Unzyp Software has been actively exploring blockchain technology, which is currently being used in the evolving Web3 space.

“We have a product that focuses on the Web3 industry,” Pranata shared. “Additionally, we still rely on partners in the fields of security technology and AI.”

Plans are underway to roll-out new product lines in collaboration with key AI partners to assist small companies in implementing these technologies.

“We also see a good opportunity during the political year in Indonesia,” Pranata added.

“Many political parties want to have systems equipped with AI to understand political sentiment and public opinion about candidates. With so many political parties in Indonesia, this is akin to planting a seed and then harvesting it when the time comes.”

Inform your opinion with executive guidance, in-depth analysis and business commentary.