August 14, 2023

Enterprise adoption of the metaverse is not expected to reach mainstream levels for at least another five to 10 years but businesses that commit early are expected to be rewarded.

According to Bain & Company findings, the metaverse industry could reach up to $900 billion by 2030 yet based on current market conditions and boardroom priorities, may remain in the seed stage until the next decade.

In the report – Taking the Hyperbole Out of the Metaverse – analysts advised that the metaverse poses “real and growing” economic opportunities for businesses with organisations that engage in the early stages of development expected to become market winners.

“As the metaverse quickly evolves, we’ve already seen these types of technologies take hold within different industries,” said Chris Johnson, Partner at Bain. “A good example of this is immersive gaming platforms, which are already boasting hundreds of millions of monthly active users.”

For Johnson, the metaverse is – and will be – plural.

Justification for this analysis is centred on consumer and enterprise applications becoming increasingly immersive and collaborative. As a result, Bain reported that it’s unlikely that the metaverse will emerge as one singular platform.

“Instead, platforms with large user bases today may take steps to become increasingly immersive and engaging, while smaller, metaverse-like environments will try to attract bigger user bases,” he noted.

“These virtual worlds are likely to remain independent silos as private companies seek to recoup their investments by leveraging the value of the underlying data sets.”

Johnson said industries that have since exhibited the use of metaverse-type technologies include but are not limited to: entertainment, manufacturing, healthcare, education and employee training.

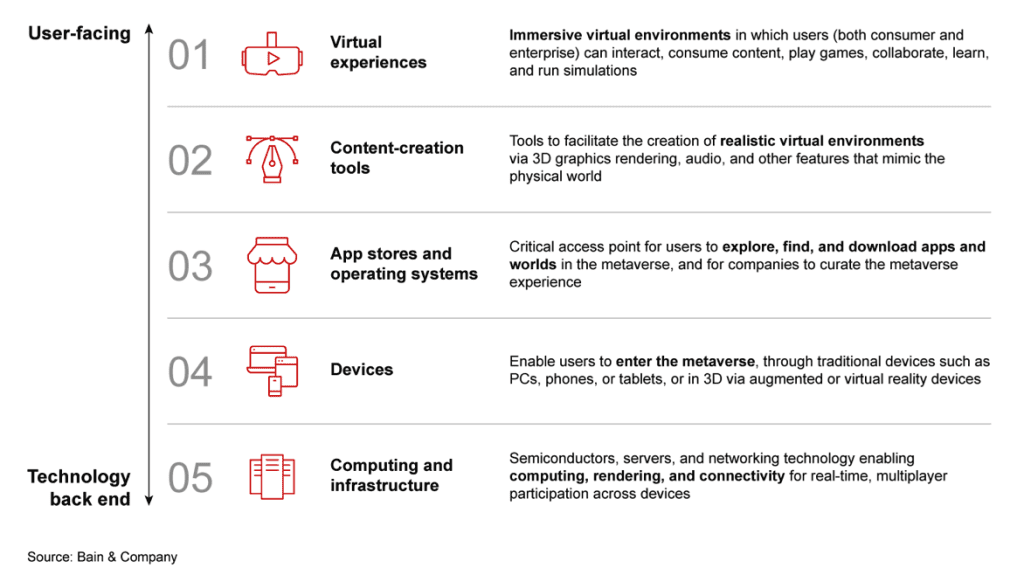

“And while it’s not immediately clear how the metaverse landscape will shift, our research shows there are five competitive battlegrounds that executives should be considering if they wish to get ahead and eventually scale,” Johnson added.

“This is an ongoing journey toward more immersive and collaborative experiences, enabled by rapid improvements in the underlying technology.”

According to Bain, five key competitive battlegrounds that executives should consider to gain market share in the metaverse include:

Inform your opinion with executive guidance, in-depth analysis and business commentary.