October 23, 2023

Hesitation among CIOs to invest in new projects and initiatives is pushing a significant portion of IT spending allocated for 2023 into 2024, as a wave of “change fatigue” slows down technology upgrades and deployments.

The domino effect of such hesitation – widely considered an enterprise issue irrespective of market or sector – is an ecosystem of vendors, distributors and channel partners now operating in a serious state of limbo as budgets move between quarters at pace.

While the delaying of projects is not new and remains reflective of challenging economic trading conditions, this trend is expected to continue into 2025 suggesting a further 12-18 months of market uncertainty ahead.

“Faced with a new wave of pragmatism, capital restrictions or margin concerns, CIOs are delaying some IT spending,” said John-David Lovelock, Vice President Analyst at Gartner. “Organisations are shifting the emphasis of IT projects towards cost control, efficiencies and automation, while curtailing IT initiatives that will take longer to deliver returns.”

As noted by Lovelock, the bottleneck is occurring among CEOs and CFOs who remain hesitant to sign new IT contracts and instead, are asking for more sureties on risks and rewards to move deals forward.

“Enterprises and governments are facing higher borrowing costs, skills shortages, cloud pricing increases and supply chain disruptions – leading to reevaluation of return on investment [ROI] for ongoing and proposed projects,” Lovelock added.

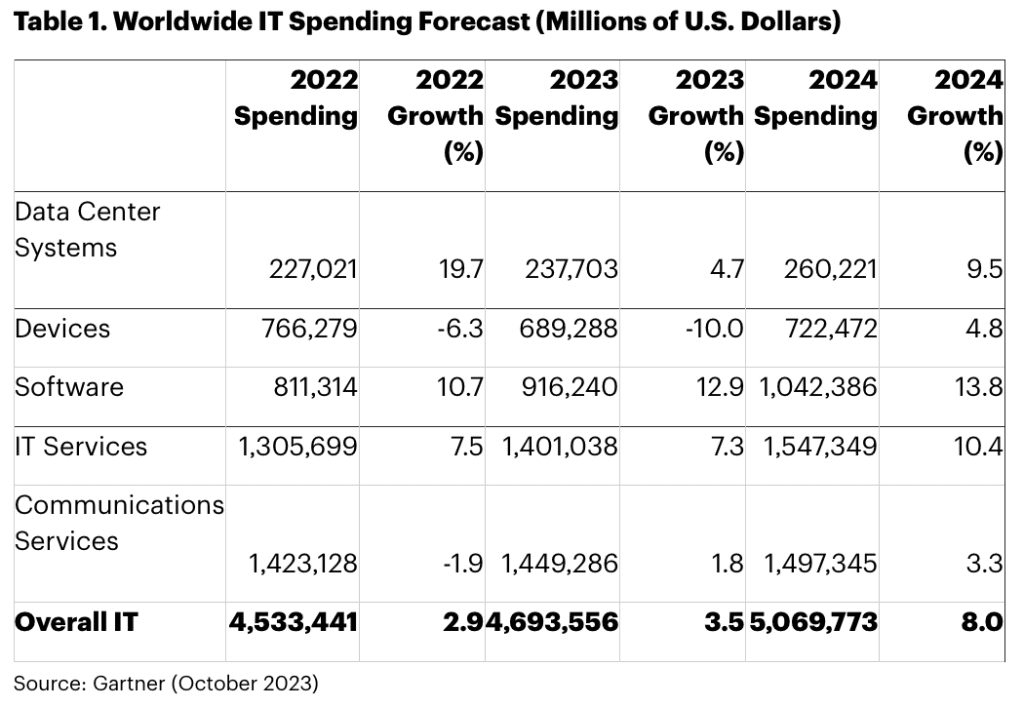

According to Gartner, this is playing out in the numbers with worldwide IT spending projected to total $5.1 trillion in USD during 2024, representing an increase of 8% from 2023.

“The ‘growth at all costs’ strategy pursued for more than 10 years is giving way to a greater focus on efficient growth and a refocus on costs,” Lovelock highlighted.

Spending by tech segment

Despite ongoing market challenges, the software and IT services segments are both expected to experience double-digit growth in 2024, largely driven by increased cloud investment.

Global spending on public cloud services is forecast to increase 20.4% in 2024 – and similarly to 2023 – the source of growth will be a combination of cloud vendor price increases and accelerated utilisation.

While inflation’s effect on both consumers and businesses plagued the devices market throughout 2022 and 2023, Lovelock said devices spending will begin to rebound “modestly” in 2024, growing 4.8% in the process.

Meanwhile, cyber security spending is also driving growth in the software segment. According to Gartner, 80% of CIOs plan to increase spending on cyber / information security in 2024, the top technology category for increased investment.

“AI has created a new security scare for organisations,” Lovelock said. “Gartner is projecting double-digit growth across all segments of enterprise security spending for 2024.”

While generative AI has not yet had a “material impact” on IT spending, Lovelock said investment in AI more broadly is supporting overall IT spending growth.

“In 2023 and 2024, very little IT spending will be tied to generative AI,” Lovelock noted. “However, organisations are continuing to invest in AI and automation to increase operational efficiency and bridge IT talent gaps.

“The hype around generative AI is supporting this trend, as CIOs recognise that today’s AI projects will be instrumental in developing an AI strategy and story before generative AI becomes part of their IT budgets starting in 2025.”

CFOs tackle ‘deadweight’ economy

A key reason for the delay in IT projects is the “deadweight” economy that continues to challenge an organisation’s ability to meet corporate performance expectations.

“Growing economic optimism in advanced economies obscures an inconvenient truth: favourable conditions that have powered growth in the last decade are no longer present,” said Randeep Rathindran, Vice President of Research at Gartner.

For Rathindran, CFOs are now contending with tepid demand growth, stubbornly higher costs and constrained access to capital.

“The deadweight economy challenges an organisation’s ability to meet corporate performance expectations by constraining traditional avenues for growth, pricing, investment funding, cost management, people management and productivity gains,” Rathindran added.

“Deadweight economic conditions can be expected to linger through most, if not all, of organisations’ current strategic planning horizons.”

According to Rathindran, CFOs must address five emerging challenges to drive profitable growth in this environment.

“While the average organisation will resort to managing against short-term economic volatility, forward-thinking companies that can successfully navigate these challenges will dramatically improve their performance trajectory and create sustained competitive advantages,” Rathindran advised.

Inform your opinion with executive guidance, in-depth analysis and business commentary.