February 6, 2024

Even though the GenAI bubble is showing no signs of bursting – pumped up by marketing rhetoric and industry buzz – businesses remain hindered by an inability to maximise its potential.

That age-old conundrum of converting hype into reality is playing out in boardrooms across the enterprise with CEO patience beginning to wear thin.

According to Boston Consulting Group (BCG) findings, 90% of executives are either waiting for GenAI to move beyond the hype or are experimenting in small ways – in a majority group labelled “observers”.

Delving deeper, 66% of executives are “ambivalent or outright dissatisfied” with organisational progress specific to AI and GenAI so far.

The three primary reasons for such dissatisfaction are:

In this context, most companies can best be described as either “playing catch up or standing on the sidelines”. More than 60% of executives are still waiting to see how AI-specific regulations develop and just 6% of companies have trained more than 25% of their people on GenAI tools so far.

“This is the year to turn GenAI’s promise into tangible business success,” said Christoph Schweizer, CEO of BCG.

“Almost every CEO, myself included, has experienced a steep learning curve with GenAI. When technology is changing so quickly, it can be tempting to wait and see where things land. But with GenAI, the early winners are experimenting, learning and building at scale.”

Findings originate from the report – BCG AI Radar: From Potential to Profit with GenAI – which is based on a survey of 1,406 C-level executives spanning 50 markets and 14 industries.

As outlined by Schweizer, “winning” companies acknowledge GenAI’s “permanence” and recognise its potential for both enhanced productivity and top-line growth. Notably, the top five characteristics that set the winners apart are:

“To unlock GenAI’s full potential, executives should deploy it to improve efficiency of everyday tasks, reshape critical functions, and invent new business models,” Schweizer added. “Doing so can increase productivity by up to 20%, enhance efficiency and effectiveness by up to 50%, boost revenue and create long-term competitive advantage.”

Like many organisations, Kingfisher – a UK-based retail group – initially restricted all access to ChatGPT and similar large-language models.

“We had a lot of complaints,” acknowledged Thierry Garnier, CEO of Kingfisher. “But you have to trust people and have clear principles.

“So we worked together across functions, including HR and IT, and gradually provided access, established rules, and offered mandatory training on best practices and dangers – and these principles allowed us to have a path forward.”

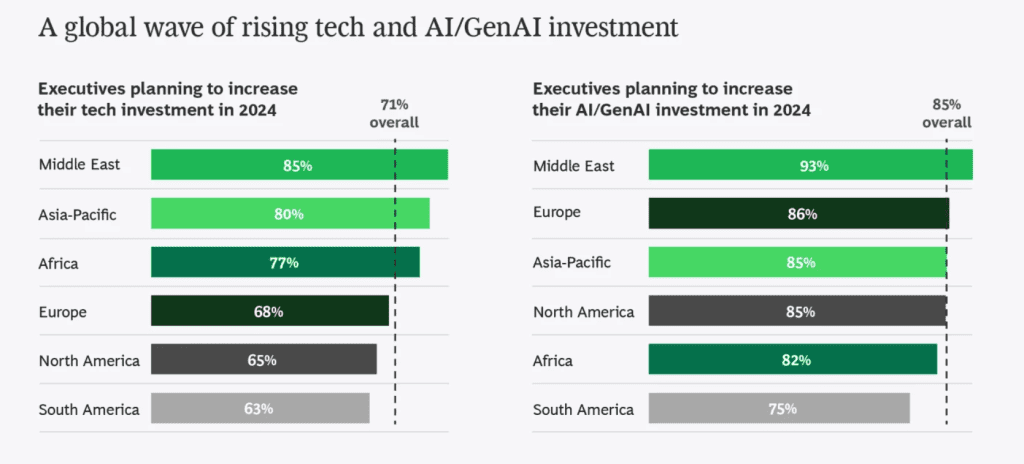

Looking ahead, 71% of executives plan to increase technology investments in 2024, representing an 11-point jump from 2023.

Even more (85%) plan to increase spending on AI and GenAI with 54% already expecting AI to provide cost savings during the next 12 months, primarily through productivity gains in operations, customer service and IT.

“Generative AI is radically reshaping businesses,” noted Sylvain Duranton, Global Leader at BCG X.

“Leading companies on the GenAI front are planning to realise up to $1 billion in productivity gains, and they are already looking at ways to reinvest into new business models and growth. This is a second chance for companies who missed the first AI wave.”

Inform your opinion with executive guidance, in-depth analysis and business commentary.