October 9, 2023

Positive occupancy sentiment is flowing through the office markets of Auckland, Wellington and Christchurch, with workers now demonstrating greater appetite for weekday city life.

In New Zealand, 70% of city-based employees now want to spend at least three days a week with colleagues in the office, on the basis that workplaces are collaborative, modernised and housed in well-located environments.

That’s according to Office Sentiment Survey findings – published by global real estate services firm, JLL – amid a local and global struggle from companies to convince staff to return to the office.

“Kiwis are responding positively to the carrot of well-located, fit-for-purpose premises with quality amenities that allow them to work collaboratively and socialise with their colleagues,” said Gavin Read, Head of Research in New Zealand at JLL.

This is in stark contrast to the US however, with attendance still sitting at around just 50%.

“Prominent technology, insurance, telecommunications and law companies as well as federal government departments are increasingly having to resort to the stick of return-to-office mandates for staff in the US,” Read outlined.

In highlighting the opinion of 318 Kiwi office employees, occupiers and owners, Read said the Office Sentiment Survey demonstrated increased staff satisfaction with current working environments compared to the height of COVID-19.

“Back in in 2021, when companies were still coming to grips with the post-lockdown return to work, our first survey had employee workplace satisfaction down at a Net Promoter Score [NPS] of -5,” Read said.

With facilities such as tech-enabled meeting spaces, huddle zones and hot-desking more prevalent, this NPS now sits at +20.

“Alongside this, 90% of employees say they’re happy with the flexible working arrangements offered by their employer,” Read detailed.

Impact on office occupancy

The knock-on impact of changing employee work preferences has created “positive sentiment” in the office markets of major cities in New Zealand.

According to JLL, office occupancy within CBD areas is currently:

Moving into 2024, JLL forecasts rental growth will continue for “well-located, quality properties” that are aligned with occupier and employee requirements.

According to findings, just under half (45%) of businesses are utilising 80% or more of their workspace, with 6% utilising less than 30%. This is considerably lower than two years ago with 85% of the occupiers utilising 80% or more of their workspace in 2021, and only 2% utilising less than 30%.

In response, over half of organisations (54%) are considering a change of space, with sentiment mixed on whether to reduce (16%), increase (14%) or reconfigure (25%) office environments.

“The theme that more change is still to come in the office sector aligns to the conversations we are having within New Zealand,” Read shared. “Many occupiers are yet to start the journey of providing the optimum space for their employees and understanding the importance of getting this right to retain and attract staff.”

As outlined in the research, medium lease terms continue to be the norm in New Zealand with 42% of new contracts running between 1-3 years – only 35% are between 4-6 years.

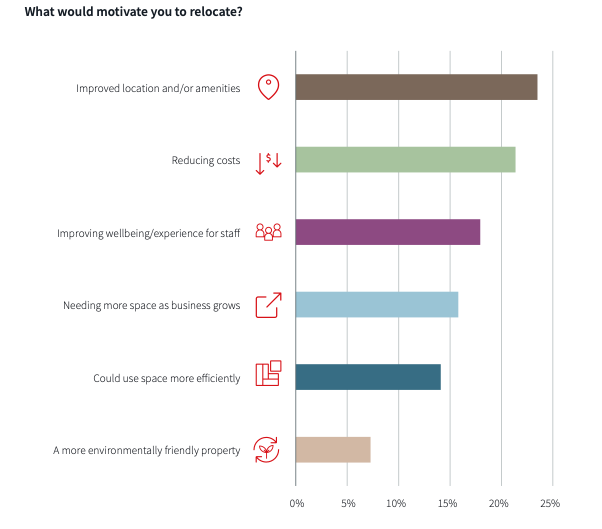

When assessing the motivation to move office, two of the top three reasons for Kiwi companies centred around staff.

The top reason (24%) was to improve location and/or amenities while the third (18%) was to enhance well-being and experience levels for staff – sandwiched between was the need to reduce costs (21%).

“Having amenities close to the office, such as childcare, gyms, retail and hospitality, was the third-most important consideration for an occupier,” Read explained.

“This shows that they are thinking more about the well-being of their staff and how they can best retain and attract top talent with a strategic, modern workplace that caters to a wide range of needs and conveniences.”

For Read, business sentiment is also aligned when looking at what occupiers think is the most important for their workplace.

“While environmental considerations such as Green Star and NABERS ratings are significant and can be included as part of a modern fit-out, the ‘quality of space’ and ‘location for easy travel’ together are the two most important categories for occupiers,” he added.

Inform your opinion with executive guidance, in-depth analysis and business commentary.