October 30, 2024

No industry is immune to efficiency challenges and no vertical is safe from performance issues – perennial problems facing organisations of all sectors, shapes and sizes.

That constant quest for improvement, the aggregation of marginal gains and the pursuit of 1% extra can make the difference between market success and failure.

For businesses, this isn’t a Just Do It type scenario. That world-famous tagline has nothing to do with winning, it has everything to do with doing.

The spirit of Nike, as described by visionary founder Phil Knight is simple… “the next time you’re out running before the sun is up, it’s dark, it’s cold and it’s wet and you’re running by yourself – we are the ones standing under the lamp post cheering you on.”

Nike is about embracing the journey, not necessarily the destination.

In the context of corporate productivity however, productivity is about both the means and the ends.

This isn’t about working harder, rather smarter in the pursuit of growth – a concept the construction sector in Australia is currently grappling with.

“The construction industry is at a crossroads,” observed Hani Arab, CIO of Seymour Whyte. “Stagnating productivity is threatening its contribution to the national economy and the quality of life for Australians.”

On paper, the contribution is sizeable with the industry considered a “significant pillar” of the national economy, accounting for approximately 9% of gross domestic product (GDP) and employing more than 1.2 million people across the country.

In practice, this is an industry that shapes the quality of life for Australians through the development of essential infrastructure, housing and public facilities.

“Despite its critical role in the nation’s growth, the industry faces a persistent and troubling challenge – stagnating productivity,” Arab added.

During recent years, sectors such as manufacturing have embraced technological innovations to achieve notable productivity gains – chiefly in the areas of the Internet of Things (IoT), robotic process automation (RPA) and now artificial intelligence (AI) and machine learning (ML). Yet adjacent to this, the construction industry has lagged.

“This productivity slowdown poses serious risks, particularly in the construction delivery phase, where inefficiencies can lead to costly delays, reduced profit margins and budget overruns,” Arab said.

“Addressing this challenge is vital for the industry’s long-term sustainability, especially given its outsized role in the national economy.”

Arab speaks with authority on this topic following more than 25 years of experience at the heart of the Australian construction industry, holding a range of IT leadership roles in the process.

After completing a Bachelor of Civil Engineering, Arab entered the world of technology and has since developed and managed large ICT infrastructure teams, built data centres and implemented a range of cutting-edge platform solutions.

Arab joined Seymour Whyte as CIO in July 2023, a multi award-winning civil contractor that delivers major essential infrastructure across Australia. Prior to this, technology leadership roles spanned Assetlink, AssetFuture and Lendlease.

Context key as challenges persist in productivity battle

In construction, productivity can be measured by how efficiently inputs – such as labour, materials and machinery – are transformed into outputs in the form of buildings and infrastructure.

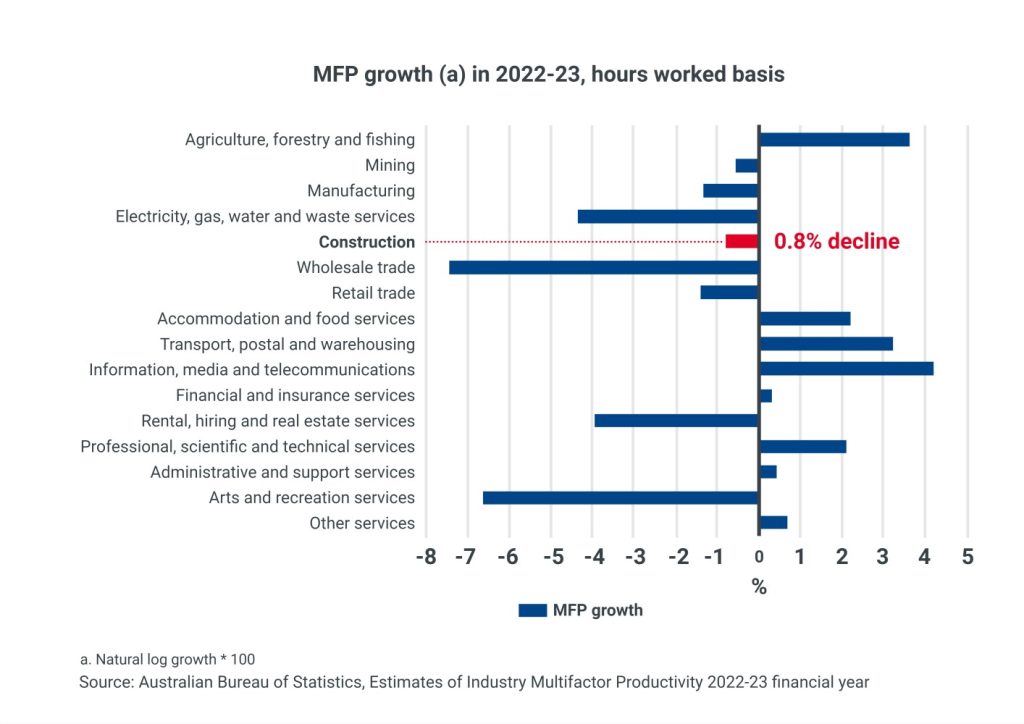

Based on the Australian Bureau of Statistics (ABS), productivity is tracked via a range of metrics, including labour productivity (output per hour worked), capital productivity (output per unit of equipment or machinery) and multi-factor productivity (MFP), which combines both labour and capital inputs.

Labour productivity alone can account for up to 40% of total project costs in construction.

“While these metrics have improved in other sectors, construction has struggled to keep pace,” Arab outlined.

Issues such as environmental complexities remain ever present with organisations continually navigating incomplete project designs, rework requests and fluctuating supervisor competence levels. Not forgetting daily exposure to external factors such as weather, plus delivery delays and inefficiencies.

Throw in rising compliance burdens in the form of ESG (Environmental, Social and Governance) and the problem of productivity worsens.

“Construction firms face growing administrative demands as governments enforce stricter safety, environmental and quality standards,” Arab added.

“Compliance reporting is often a manual, time-consuming process that requires significant data handling and management. The process adds layers of administrative complexity, which can divert attention and resources away from core construction activities.”

Despite the demonstrable benefits of improved productivity – and widespread acknowledgment that action is required – moving away from manual tasks is no easy endeavour for businesses also battling economic headwinds.

Today, Australia is an inward looking market.

According to Moxie Research – which surveyed 251 CIOs in Australia during February 2024 – the number one priority for local organisations is currently cost control and expense management. For 50% of companies, this is the leading agenda item.

Delving deeper – and to best understand the personas behind technology investment decisions – Moxie Research also asked IT leaders to outline which statement they most closely and currently self-identified as (multiple selections were accepted).

Reflective of a turbulent economy – and continued post-pandemic market volatility – organisations are fine-tuning plans to reposition for sustained future growth. In order of priority, central to ‘Strategist’ efforts are intentions to:

In the context of productivity in construction, strategic priorities no.1 and no.4 are intertwined.

Yes, this is a nation still fighting financial and economic pressures. But within such strife, up-skilling and advancement is now viewed as mission-critical.

“The construction industry stands at a crucial juncture,” Arab said.

“While productivity has remained stagnant for years, the tools to reverse this trend are readily accessible. The key is in overcoming the industry’s slow rate of technological adoption and resistance to change.”

For Arab, the good news is that many of the solutions required – such as automation, mobile platforms, real-time analytics and compliance management tools – are “scalable and flexible”.

“Meaning they can be tailored to specific business models and project types within the construction sector,” he advised. “Incorporating these technologies is no longer an aspirational goal but a practical, immediate necessity.

“Construction firms that embrace these tools will enhance their productivity and position themselves to remain competitive in an increasingly technology-driven marketplace. The ability to deliver projects faster, at a lower cost, and with higher precision, will set forward-thinking firms apart.”

For example, utilising a digital platform to automate compliance processes end-to-end can deliver a more than 80% increase in efficiency through time-saving.

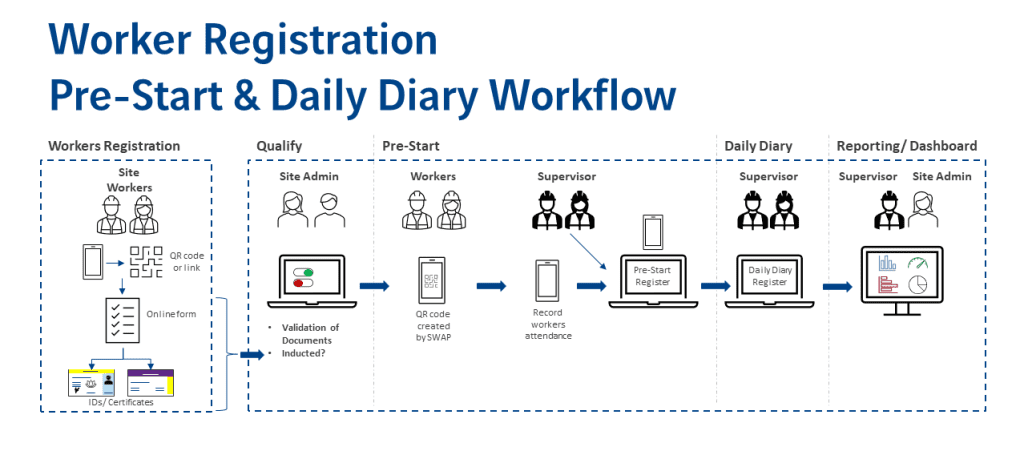

The Contractor Worker Registration process ensures that construction workers are informed about site-specific conditions and that their qualifications or competency are verified before conducting work.

“It seems simple enough,” Arab acknowledged. “However, capturing, checking, managing and reporting can be a full-time job for more than one person, depending on the project size. A digital native solution is inherently scalable, requiring no additional effort as volume increases.”

Role of tech in powering productivity gains

Today, CIOs in Australia are balancing pragmatism with progress as the need to reduce financial risk is counterbalanced by a desire to evolve and expand. This is a technological tightrope that many leading executives are walking and such sentiment is shaping solution and services investment.

Based on Moxie Research, the top three areas in which IT executives will increase deployment during the next 6-12 months are:

For the majority, that translates into a need to strengthen cyber security defences as a primary company priority (63%), which is unsurprising given a spike in attacks impacting local businesses.

Beyond the core, 2025 will be shaped by key initiatives such as removing reliance on outdated or obsolete technology environments (57%) and accelerating the journey to in-house technology modernisation (53%).

This is motivated by a desire to clear the corporate decks to enhance and enable new product development (49%) when market conditions improve, which in turn will help create a breeding ground for disruptive technologies (47%) to better monetise and maximise company data (47%).

“One of the most promising areas for improving productivity lies in adopting technology,” Arab acknowledged.

“The industry can unlock significant productivity gains by embracing mature and scalable technologies. These solutions, proven in other sectors, offer a direct path to more efficient project delivery, reduced costs and enhanced outcomes.”

For example, Arab said technology has the potential to improve construction site productivity, streamline compliance reporting and reduce the administrative burden.

“Digital tools can automate large parts of the compliance process, helping firms track safety data, environmental metrics and other regulatory requirements in real-time,” Arab explained.

“Construction companies can use mobile apps, cloud-based platforms and integrated software systems to generate reports on demand, monitor ESG compliance and ensure they meet legal requirements without overwhelming their workforce with paperwork.”

Improvements in ESG reporting is timely with 50% of Australian CIOs focused on embracing sustainable technologies, processes and best practices in 2025. According to Moxie Research, 41% will also hold outsourcing partners – and the technologies delivered and deployed – accountable to sustainability policies.

“These tools can drastically reduce the time spent on compliance-related tasks, allowing project managers and workers to focus more on value-adding activities,” Arab added.

“For instance, automated data collection and reporting platforms can help companies stay on top of safety inspections, worker certifications, energy usage and environmental impact assessments, reducing the risk of non-compliance and the associated penalties.”

Translated into tangible return on investment (ROI), McKinsey estimates that adopting digital solutions can reduce construction costs by up to 15%.

Another area of improvement lies in Building Information Modelling (BIM) which has “revolutionised” the pre-construction phase by enabling more precise planning, coordination and collaboration among project stakeholders.

“However, the benefits of BIM – and other digital engineering tools – must extend into the on-site construction phase if the industry is to see significant productivity improvements,” Arab cautioned.

“Technologies such as real-time project tracking, mobile applications for workforce management and enhanced automation can directly address the inefficiencies that have long plagued construction sites.”

In looking ahead, the pursuit of productivity gains spans both internal and external factors – whether that be in construction or any other sector across Australia.

On the one hand, 50% of CIOs are committed to developing high-performing IT talent and culture which for some includes up-skilling the wider organisation on new technologies (39%).

Meanwhile, 52% are tasked with identifying new opportunities to enhance customer value with spearheading transformative change and innovation as foundational requirements (41%).

“The time to act is now,” Arab advised. “By integrating technology into the construction delivery phase, the industry can secure a more sustainable and prosperous future for itself and the country.”

Inform your opinion with executive guidance, in-depth analysis and business commentary.